The following information was obtained from the financial records of Fast Track Courier Services Pty Ltd on

Question:

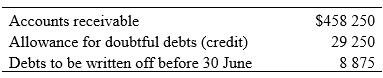

The following information was obtained from the financial records of Fast Track Courier Services Pty Ltd on 30 June 2024:

After performing an ageing analysis of receivables, the firm has requested the allowance for doubtful debts be amended to 6% of Accounts Receivable outstanding at 30 June 2024. Ignore GST.

Required:

(a) Prepare the appropriate general journal entry/ies to record the bad debts write off at 30 June.

(b) Prepare the journal entry necessary to adjust the Allowance for Doubtful Debts account after writing off the bad debts in (a).

(c) Post the journal entries from

(a) and

(b) to the Allowance for Doubtful Debts ledger account and calculate the final balance at 30 June 2024.

(d) Identify the amount(s) to be charged as bad debts expense for the year.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie