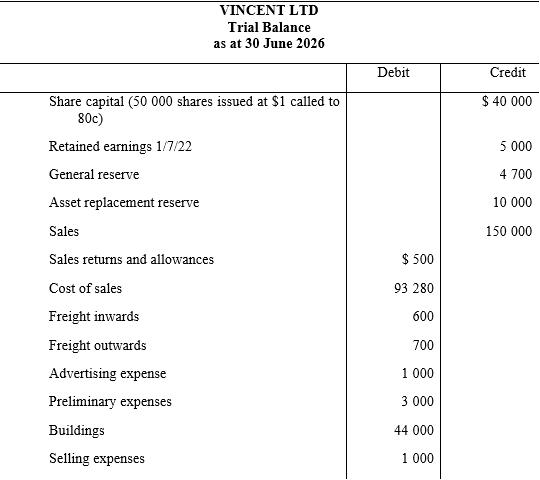

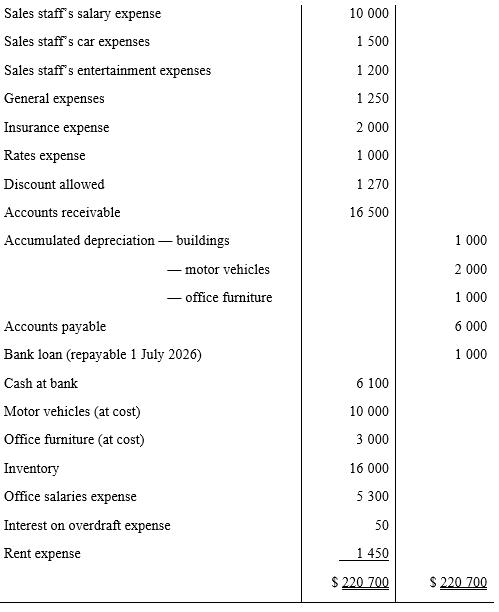

The trial balance of Vincent Ltd at 30 June 2026 is shown below. There was no movement

Question:

The trial balance of Vincent Ltd at 30 June 2026 is shown below.

There was no movement in share capital for the year.

The following adjustments are required.

1. Record income tax expense of \($7500\).

2. Transfer \($1000\) to general reserve.

3. Accrued expenses: sales staff’s salary \($650;\) office salaries \($270;\) interest on bank loan \($20\).

4. Write off preliminary expenses \($3000\).

5.Rent prepaid \($300\).

6. Record depreciation: motor vehicles 10% on cost; office furniture 20% on cost; buildings 5%.

7. Recommend a dividend of 20c per share.

Required

(a) Prepare an income statement, a statement of changes in equity for the year ended 30 June 2026 and a balance sheet for Vincent Ltd as at 30 June 2026.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie