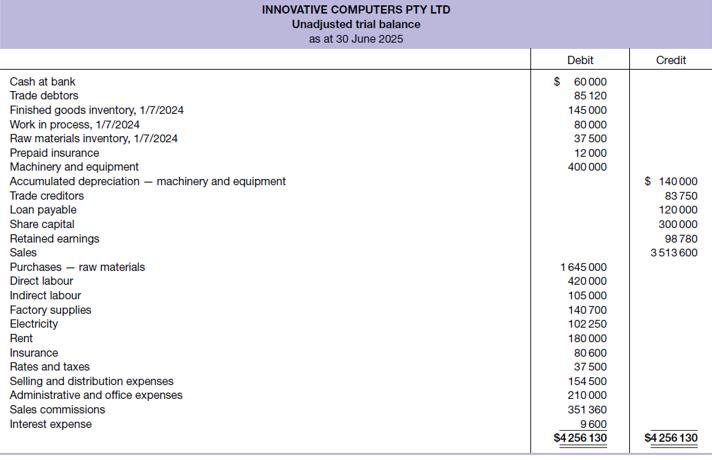

The unadjusted trial balance of Innovative Computers Pty Ltd on 30 June 2025 is presented below. The

Question:

The unadjusted trial balance of Innovative Computers Pty Ltd on 30 June 2025 is presented below.

The following additional information is available.

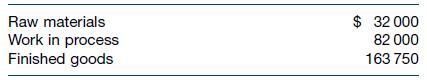

1. The inventories as of 30 June 2025 were as follows.

2. The Machinery and Equipment account comprises \($250\) 000 of factory machinery and the balance of office equipment. All machinery and equipment is depreciated using the straight-line method over an 8-year life. There were no plant and equipment acquisitions or disposals during the accounting period.

3. On 1 May 2025, the company paid \($12\) 000 for 12 months insurance cover on the factory. Prepaid Insurance was debited at the time of the transaction.

4. Accrued expenses at year-end but not yet recorded: direct labour, \($10\) 000; indirect labour, \($3500;\) selling and distribution expenses, \($20\) 000.

5. All electricity, rent, rates and taxes, and insurance are charged to factory operations.

6. An additional stationery expense payable of \($1500\) is to be recorded and treated as an administrative expense. No invoice has been received.

7. Ignore income tax.

Required

(a) Prepare a worksheet including pairs of columns for unadjusted trial balance, adjustments, manufacturing, and the financial statements.

(b) Prepare a cost of goods manufactured statement for the year ended 30 June 2025.

(c) Prepare the closing entries assuming use of a Manufacturing Summary account.

(d) Calculate the relationship between overhead and direct labour costs. Using that relationship, calculate the labour and overhead included in the ending inventories if work in process ending inventory contains \($25\) 000 of raw materials and \($38\) 000 of raw materials is included in the finished goods ending inventory.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie