Trang Nguyen operates a roofing business that specialises in replacing broken tiles and cleaning and repairing roofs

Question:

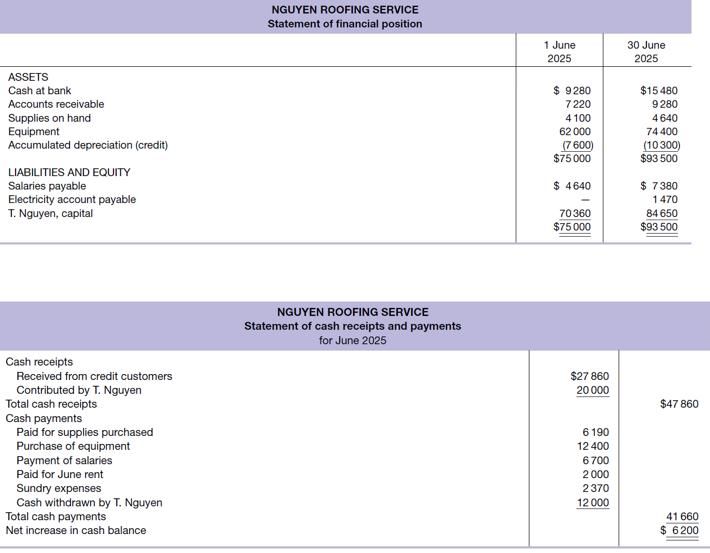

Trang Nguyen operates a roofing business that specialises in replacing broken tiles and cleaning and repairing roofs and gutters. He began business in April 2025 but has not yet established a formal set of records. His son, Tram, has prepared cash receipts and payments statements for each of the first 3 months of the business, but Trang Nguyen is worried about relying on them. He asks you to prepare a ‘proper’ set of financial statements for the month of June.

By reviewing the bank statements, cheque butts, invoice files and other data, you derive a set of balance sheets at 1 June and 30 June. These are shown below, followed by a statement of cash receipts and payments for March. GST is ignored.

(a) From the information, prepare an income statement on the accrual basis for the month of June. Hint: you may wish to prepare (reconstruct) relevant accounts.

(b) Illustrate the apparent correctness of your profit amount by preparing a statement of changes in equity for June 2025.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie