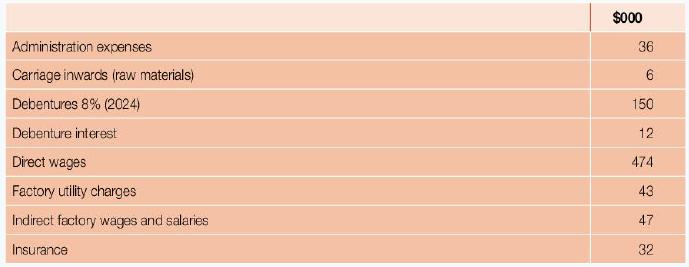

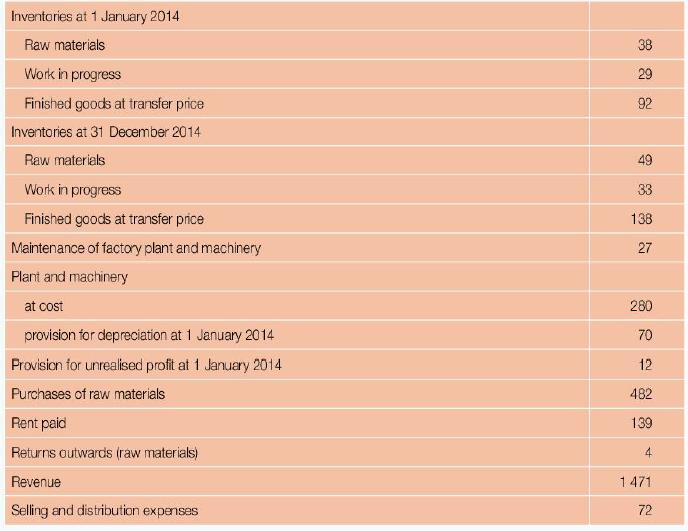

Osomo Ltd is a manufacturing organisation. On 31 December 2014 the following information was extracted from the

Question:

Osomo Ltd is a manufacturing organisation. On 31 December 2014 the following information was extracted from the company's books.

Additional information:

• The company transfers goods from the manufacturing account at a transfer price of cost plus 15 per cent.

• Rent $9000 had been paid for the three months to 28 February 2015.

• Rent and insurance should be allocated: factory 75 per cent, office 25 per cent.

• Direct wages $11 000 were due but unpaid at 31 December 2014. 110. Depreciation should be provided on plant and machinery at 30 per cent per annum using the reducing-balance method. (Depreciation on office non-current assets has already been included in the administration and selling and distribution expenses.)

• Tax on profits for the year ended 31 December 2014 has been estimated at $32 030.

a. Suggest one reason why the company transfers goods from the manufacturing account at a transfer price.

b. Prepare a manufacturing account for the year ended 31 December 2014.

c. Prepare an income statement for the year ended 31 December 2014.

d. Prepare the provision for unrealised account for the year ended 31 December 2014.

e. Explain the accounting treatment for the finished goods valued at transfer price.

Step by Step Answer:

Accounting For Cambridge International AS And A Level

ISBN: 9780198399711

1st Edition

Authors: Jacqueline Halls Bryan, Peter Hailstone