(Balance Sheet Conversion WorksheetGovernmental Activities) 2. The balance of the long-term claims and judgments obligation at December...

Question:

(Balance Sheet Conversion Worksheet—Governmental Activities)

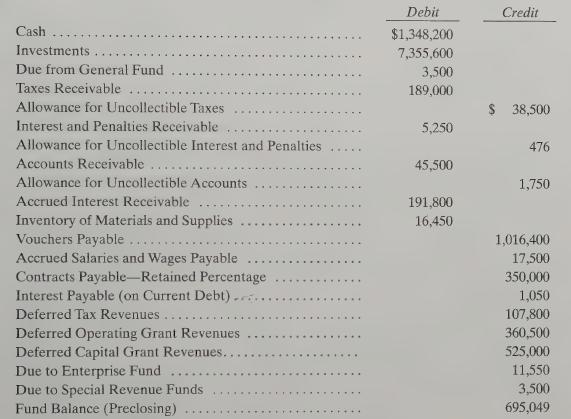

2. The balance of the long-term claims and judgments obligation at December 31, 20X5, was $450,000. All claims and judgments of the county are related to health and sanitation.

3. The balance of the long-term liability for compensated absences at December 31, 20X5, was $425,000. Compensated absence liabilities are generated equally by the general government, public safety, streets and roads, and health and sanitation functions.

4. The bond issuance occurred at year-end. The equipment purchases occurred at the beginning of the year.

5. The January 1,20X5, balance of Accrued Salaries and Wages Payable was $25,000.

6. The January 1,20X5, balance of Deferred Tax Revenues was $84,000.

7. The operating grants revenues were associated with Public Safety ($100,000) and Health and Sanitation. The capital grants were associated with Streets and Roads.

8. The accrued interest associated with bonds at December 31, 20X5, was $99,000. The January 1,20X5, balance was $87,500.

9. The remaining term of the bonds payable with which the premium ($70,000) and bond issue costs ($28,000) are associated is 10 years. Use straight-line amortization.

10. The county depreciates machinery and equipment over 5 years, buildings over 20 years, and streets and roads over 30 years. Assume zero salvage values.

11. Depreciation expense on the buildings and on the machinery and equipment is associated with functions as follows: General Government, 10%; Public Safety, 50%; Streets and Roads, 25%; Health and Sanitation, 10%; and Parks and Recreation, 5%.

12. The capital asset sold was equipment which cost $500,000 and had accumulated depreciation at the January 1 sale date of $400,000.

135 eine county’s only Internal Service Fund provides 75% of its services to Enterprise Funds and sets its billings equal to its costs of providing services. The Internal Service Fund billings to general governmental departments during the year totaled $100,000. Billings of $25,000 were associated with each functional category of expenditures except Parks and Recreation.

The December 31, 20XS5, total fund balance (postclosing) was $6,721,274. Prepare a balance sheet conversion worksheet to derive government-wide, governmental activities data for Tierney County.

Step by Step Answer:

Governmental And Nonprofit Accounting Theory And Practice

ISBN: 9780132552721

9th Edition

Authors: Robert J Freeman, Craig D Shoulders, Gregory S Allison, Terry K Patton, Robert Smith,