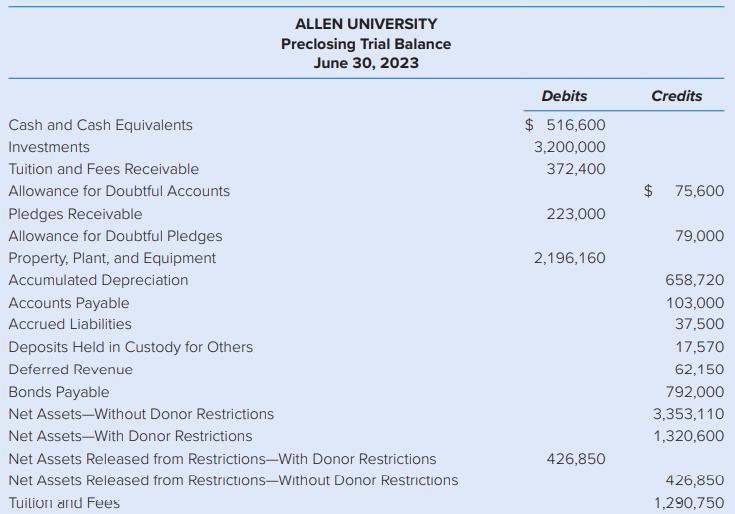

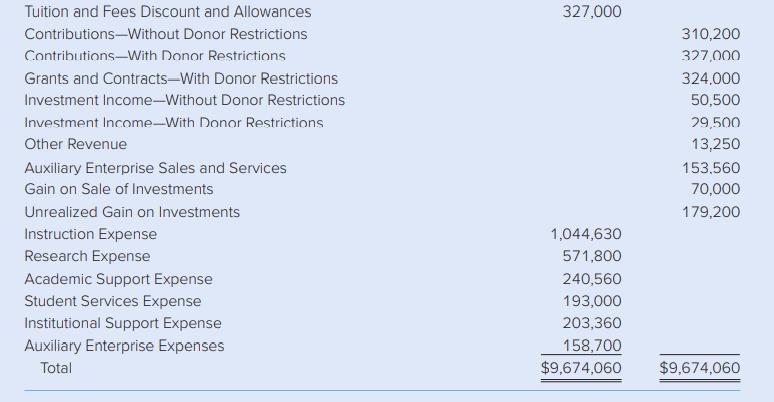

The following is the preclosing trial balance for Allen University as of June 30, 2023. Additional information

Question:

The following is the preclosing trial balance for Allen University as of June 30, 2023. Additional information related to net assets and the statement of cash flows is also provided.

Additional Information

Net assets released from donor restrictions totaled $426,850. The gain resulting from sale of investments was unrestricted. Thirty percent of the unrealized gain is related to net assets restricted for programs, with the remainder related to net assets without donor restrictions. Additional information is as follows:

The balance in cash and cash equivalents as of July 1, 2022, was $615,540. Tuition and Fees Receivable increased by $10,230. Pledges Receivable decreased by $1,560. Allowance for Doubtful Accounts was increased by $770 (the bad debt increased Institutional Support Expense).

Accounts Payable decreased by $2,900. Accrued Liabilities decreased by $1,120. Deferred Revenue increased by $6,200. Depreciation Expense was $30,070. Cash of $100,000 was used to retire bonds.

Investments were sold for $1,500,000 (at a gain of $70,000) and others were purchased for $1,250,000.

Net assets without donor restrictions were used to purchase equipment at a cost of $33,000.

Required

a. Prepare a statement of activities for the year ended June 30, 2023.

b. Prepare a statement of financial position for June 30, 2023.

c. Prepare a statement of cash flows for the year ended June 30, 2023.

Step by Step Answer:

Accounting For Governmental And Nonprofit Entities

ISBN: 9781260118858

19th Edition

Authors: Jacqueline Reck, Suzanne Lowensohn, Daniel Neely