Throup Ltd is considering extending its operations into the production and sale of components used in the

Question:

Throup Ltd is considering extending its operations into the production and sale of components used in the making of lawnmowers. The components cost £7 to manufacture and would be sold on to the lawnmower manufacturer for £12. A new machine will be needed, costing £10,000, which is payable on 1 January in year 1.

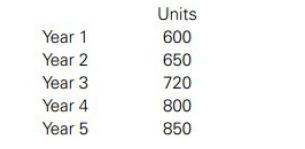

The expected sales of these components are as follows:

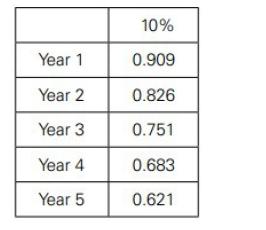

The cost of capital is 10 per cent.

The following is an extract from the present value table for £1:

It is assumed that revenues are received and costs are paid off at the end of each year, and that everything produced is sold.

(a) Calculate the annual net cash flows for each year which are expected to result from the purchase of the machine.

(b) Using the expected annual net cash flows, calculate the net present value for the machine.

Step by Step Answer: