Nelson Ltd was incorporated in 2003 with an authorised share capital of 500,000 1 ordinary shares, and

Question:

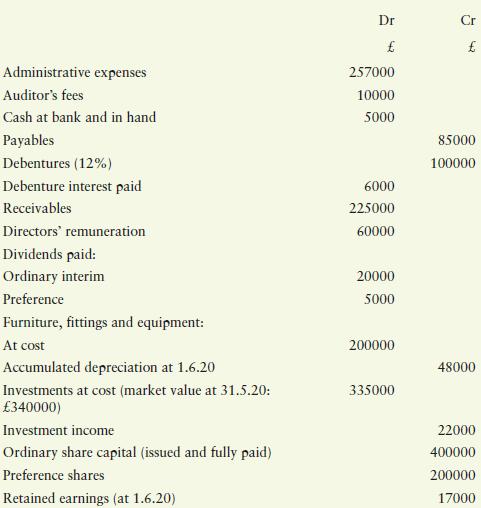

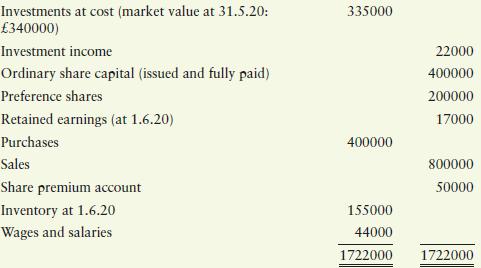

Nelson Ltd was incorporated in 2003 with an authorised share capital of 500,000 £1 ordinary shares, and 200,000 5 percent cumulative preference shares of £1 each. The following trial balance was extracted as at 31 May 2020:

Additional information:

1. Inventory at 31 May 2020 was valued at £195,000.

2. Administrative expenses owing at 31 May 2020 amounted to £13,000.

3. Depreciation is to be charged on the furniture and fittings at a rate of 12.5 per cent on cost.

4. Salaries paid in advance amounted to £4000.

5. Corporation tax owing at 31 May 2020 is estimated to be £8000.

6. Ordinary dividend was declared just before the year end of 1.25p per share. That remains to be paid.

Required:

Prepare Nelson Ltd’s trading and statement of profit or loss and statement of retained earnings for the year to 31 May 2021 and a statement of financial position as at that date.

Step by Step Answer:

Accounting For Non Accounting Students

ISBN: 9781292286938

10th Edition

Authors: John Dyson, Ellie Franklin