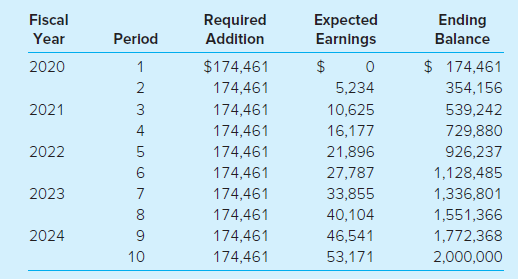

On July 1, 2019, the first day of its 2020 fiscal year, the Town of Bear Creek

Question:

Required

Create a term bond debt service fund for the town and prepare journal entries in the debt service fund for the following:

a. On July 1, 2019, record the budget for the fiscal year ended June 30, 2020. Include all inter fund transfers to be received from the General Fund during the year. An appropriation should be provided only for the interest payment due on January 1, 2020.

b. On December 28, 2019, the General Fund transferred $234,461 to the debt service fund. The addition to the sinking fund was immediately invested in 6 percent certificates of deposit.

c. On December 28, 2019, the city issued checks to bondholders for the interest payment due on January 1, 2020.

d. On June 27, 2020, the General Fund transferred $234,461 to the debt service fund. The addition for the sinking fund was invested immediately in 6 percent certificates of deposit.

e. Actual interest earned on sinking fund investments at year-end (June 30, 2020) was the same as the amount budgeted in the table. This interest adds to the sinking fund balance.

f. All appropriate closing entries were made at June 30, 2020, for the debt service fund.

Step by Step Answer:

Accounting for Governmental and Nonprofit Entities

ISBN: 978-1259917059

18th edition

Authors: Jacqueline L. Reck, James E. Rooks, Suzanne Lowensohn, Daniel Neely