Ava Mendleson operates a small fabric shop. She has been earning a satisfactory profit but is short

Question:

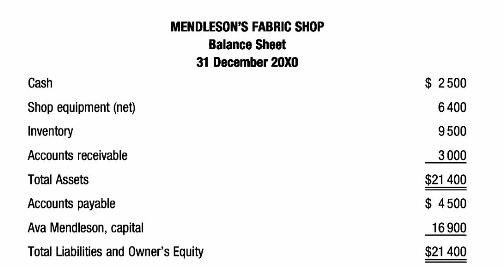

Ava Mendleson operates a small fabric shop. She has been earning a satisfactory profit but is short of cash. Here is an accurate but unclassified balance sheet of the shop on 31 December 20X0.

On 2 January 20Xl Ava went to her bank to get a loan for her business. The bank agreed to loan her \(\$ 5000\) under the following conditions. First, the note payable would be a three-year note, so the business would repay \(\$ 5000\) plus \(\$ 1500\) interest on 31 December \(20 X 3\). Second, she must prepare a 'forecasted' classified income statement for \(20 \mathrm{Xl}\) to show that the business expects to earn a net income of at least \(\$ 11000\) and that it will have 'satisfactory' profit margin and return ratios. Third, she must prepare a 'forecasted' cash flow statement for 20X1 that shows the business expects to have cash on hand at the end of \(20 \mathrm{Xl}\) of at least \(\$ 10000\) (including the cash from the bank loan) and that it will have 'satisfactory' operating cash flow ratios. Finally, she must prepare a 'forecasted' classified balance sheet as of 31 December 20X1, that shows a current ratio of at least 3.0 and a debt ratio of no more than 40 per cent. Ava has never prepared any forecasted financial statements. She understands, however, that they are prepared using the best estimates she can make, based on the shop's previous operations and her future expectations. Ava has come to you for help with the following information:

a Sales for \(20 \mathrm{Xl}\) are expected to be \(\$ 80000\). Of these, half will be cash sales and half credit sales. There are no cash discounts. Of the credit sales, 10 per cent will not be collected until 20X2. The accounts receivable on 31 December 20X0 will be collected in 20X1.

b Purchases of inventory for \(20 \mathrm{X} 1\) are expected to be \(\$ 50000\). All purchases are on credit; there are no cash discounts. Of the purchases, 12 per cent will not be paid until 20X3. The accounts payable on 31 December 20X0 will be paid in 20X1.

c Sales returns and purchases returns are expected to be insignificant.

d The business' gross profit percentage has been 40 per cent of sales, and this rate is expected in 20X1.

e The shop rents space in a local shopping centre. The rent is \(\$ 200\) per month; the rent for the whole year is due on 6 January 20X1.

f The shop equipment that originally cost \(\$ 8000\) has a 10 -year estimated life, after which it is expected to have no value.

g Ava pays her one salesperson a basic salary of \(\$ 7000\) per year, plus 10 per cent of gross sales. The total salary for \(20 \mathrm{Xl}\) will be paid in cash by the end of the year.

\(\mathrm{h}\) Ava expects to withdraw \(\$ 8000\) during \(20 \mathrm{Xl}\) to cover her personal living expenses.

i Other operating expenses are expected to be \(\$ 1600\) in \(20 \mathrm{X} 1\); these will be paid in cash by the end of the year.

You determine that the information Ava has gathered is 'reasonable' and includes her best estimates.

\section*{Required:}

i Prepare a forecasted classified income statement for 20X1. Show supporting calculations.

ii Prepare a forecasted cash flow statement for 20XI. Use the direct method for operating cash flows. Show supporting calculations.

iii Prepare a forecasted classified balance sheet as of 31 December 20X1. Show supporting calculations.

iv Calculate the applicable ratios and briefly discuss whether the business has met the bank's conditions.

Step by Step Answer:

Accounting Information For Business Decisions

ISBN: 9780170253703

2nd Edition

Authors: Billie Cunningham, Loren A. Nikolai, John Bazley, Marie Kavanagh, Geoff Slaughter, Sharelle Simmons