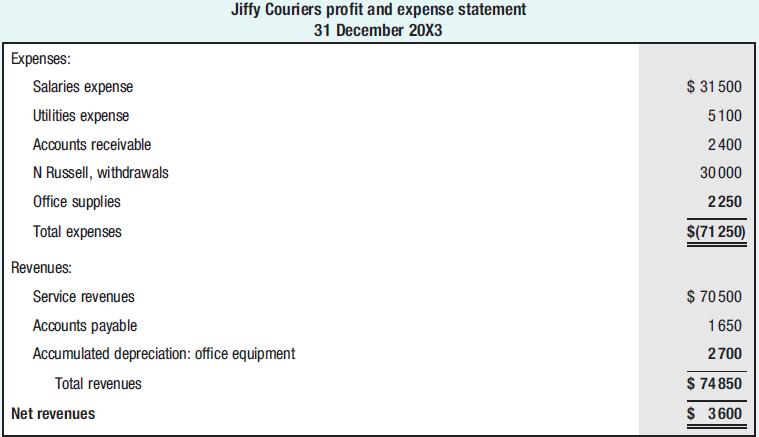

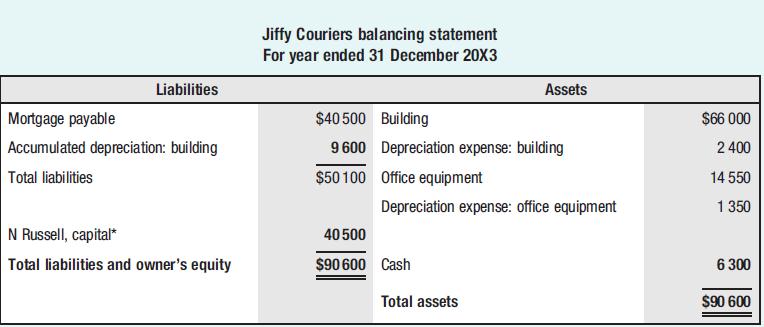

Neil Russell, the owner and bookkeeper for Jiffy Couriers, was confused when he prepared the following financial

Question:

Neil Russell, the owner and bookkeeper for Jiffy Couriers, was confused when he prepared the following financial statements:

Required:

a Review each financial statement and indicate any errors you find.

b Prepare a corrected 20X3 income statement, statement of changes in owner’s equity and ending balance sheet.

c Calculate the profit margin for 20X3 to verify or refute Mr Russell’s claim that his business had ‘a fantastic year’.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting Information For Business Decisions Accounting

ISBN: 9780170446242

4th Edition

Authors: Billie Cunningham, Loren A. Nikolai, John Bazley, Marie Kavanagh

Question Posted: