The trial balance of Halsey Architectural Consultants on 30 June of the current year (the end of

Question:

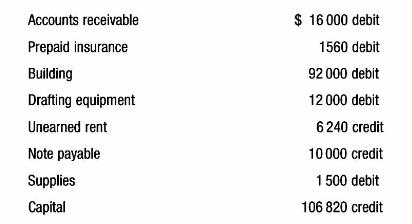

The trial balance of Halsey Architectural Consultants on 30 June of the current year (the end of its annual accounting period) included the following account balances before adjustments.

In reviewing the business' recorded transactions and accounting records for the current year, you find the following information pertaining to the 30 June adjustments:

a On 1 January the business had accepted a \(\$ 16500\), one-year, 10 per cent note receivable from a customer. The interest is to be collected when the note is collected.

b On 1 April the business had paid \(\$ 1760\) for a three-year insurance policy.

c The building was acquired several years ago and is being depreciated using the straight-line method over a 20-year life with no residual value.

d The drafting equipment was purchased on 1 June. It is to be depreciated using the straightline method over an eight-year life with no residual value.

e On 1 January the business had received \(\$ 6644\) for two years' rent in advance for a portion of its building rented to Shields Company.

f On 1 May the business had issued a \(\$ 10000\), three-month, 9 per cent note payable to a supplier. The \(\$ 225\) total interest is to be paid when the note is paid.

g On 1 July the business had \(\$ 200\) of supplies on hand. During the year the business purchased \(\$ 1300\) of supplies. A count on 30 June determined that \(\$ 90\) of supplies are still on hand.

h On 1 June an entry to record Prepaid Rates of \(\$ 6600\) for 12 months had not been recorded. Record the entry and make the adjustment required at 30 June to report rates expenses.

Required:

i Prepare the adjusting entries that are necessary to bring the Halsey Architectural Consultants accounts up-to-date on 30 June. Each journal entry explanation should summarise your calculations.

Step by Step Answer:

Accounting Information For Business Decisions

ISBN: 9780170253703

2nd Edition

Authors: Billie Cunningham, Loren A. Nikolai, John Bazley, Marie Kavanagh, Geoff Slaughter, Sharelle Simmons