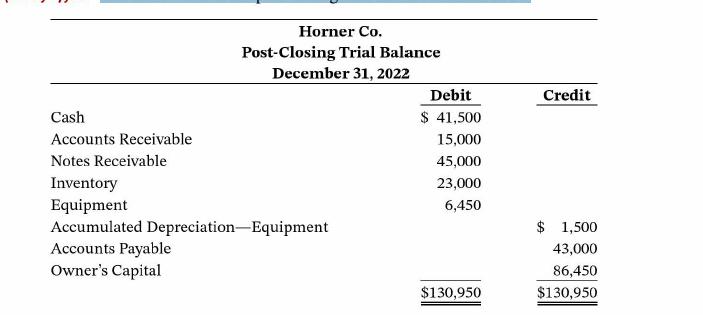

Presented below is the post-closing trial balance for Horner Co. The subsidiary ledgers contain the following information:

Question:

Presented below is the post-closing trial balance for Horner Co.

The subsidiary ledgers contain the following information: (1) accounts receivable- B. Hannigan $2,500, I. Kirk $7,500, and T. Hodges $5,000; (2) accounts payable-T. Igawa $12,000, D. Danford $18,000, and K. Thayer $13,000. The cost of all merchandise sold was 60% of the sales price. The transactions for January 2023 are as follows.

Jan. 3 Sell merchandise to M. Ziesmer $8,000, terms 2/10, n/30.

5 Purchase merchandise from E. Pheatt $2,000, terms 2/10, n/30.

7 Receive a check from T. Hodges $3,500.

11 Pay freight on merchandise purchased $300.

12 Pay rent of $1,000 for January.

13 Receive payment in full from M. Ziesmer.

14 Post all entries to the subsidiary ledgers. Issued credit of $300 to B. Hannigan for returned merchandise.

15 Send K. Thayer a check for $12,870 in full payment of account, discount $130.

17 Purchase merchandise from G. Roland $1,600, terms 2/ 10, n/30.

18 Pay sales salaries of $2,800 and office salaries $2,000.

20 Give D. Danford a 60-day note for $18,000 in full payment of account payable.

23 Total cash sales amount to $9,100.

24 Post all entries to the subsidiary ledgers. Sell merchandise on account to I. Kirk $7,400, terms 1/10, n/30.

27 Send E. Pheatt a check for $950.

29 Receive payment on a note of $40,000 from B. Stout.

30 Post all entries to the subsidiary ledgers. Return merchandise of $300 to G. Roland for credit.

Instructions

a. Open general and subsidiary ledger accounts for the following. 01 Cash 301 Owner's Capital 112 Accounts Receivable 401 Sales Revenue 115 Notes Receivable 412 Sales Returns and Allowances 120 Inventory 414 Sales Discounts 157 Equipment sos Cost of Goods Sold 158 Accumulated Depreciation-Equipment 726 Salaries and Wages Expense 200 Notes Payable 729 Rent Expense 201 Accounts Payable

b. Record the January transactions in a sales journal, a single-column purchases journal, a cash receipts journal, a cash payments journal and a general journal.

c. Post the appropriate amounts to the general ledger. (Post summary totals from the special journals before the daily entries from the general journal.)

d. Prepare a trial balance at January 31, 2023.

e. Determine whether the subsidiary ledgers agree with controlling accounts in the general ledger.

Step by Step Answer:

Accounting Principles

ISBN: 9781119707110

14th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Jill E. Mitchell