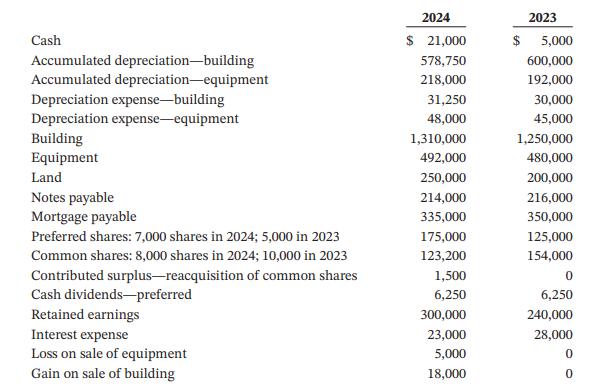

Bird Corp., a private company reporting under ASPE with a December 31 year end, reported the following

Question:

Bird Corp., a private company reporting under ASPE with a December 31 year end, reported the following in its financial statements:

Additional information:

1. Purchased land for $50,000 and building for $130,000 by making a $25,000 down payment and financing the remainder with a note payable.

2. A building was sold during the year.

3. Cash was used to purchase equipment.

4. Equipment with an original cost of $28,000 was sold during the year.

5. Mortgage payable and notes payable payments included interest and principal amounts.

6. The company paid $157,000 of notes payable that matured during the year.

7. The company reacquired 2,000 common shares in 2024, with an average cost of $30,800.

8. Preferred shares were sold for cash.

Instructions

a. Determine the amount of any cash inflows or outflows related to investing activities in 2024.

b. What was the amount of profit reported by Bird Corp. in 2024?

c. Determine the amount of any cash inflows or outflows related to financing activities in 2024.

d. Identify and determine the amount of any noncash financing activities in 2024.

e. Calculate the cash provided (used) by operating activities.

Is it favorable for a company to have a net cash inflow from investing activities?

Step by Step Answer:

Accounting Principles Volume 2

ISBN: 9781119786634

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak