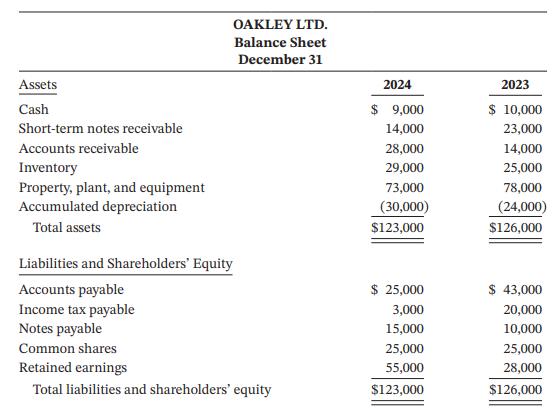

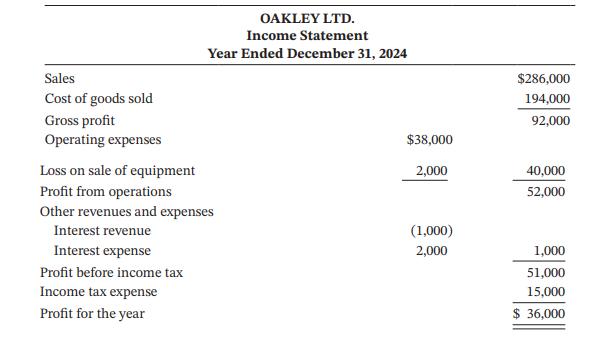

The financial statements of Oakley Ltd., a private company reporting under ASPE, follow: Additional information: 1. Short-term

Question:

The financial statements of Oakley Ltd., a private company reporting under ASPE, follow:

Additional information:

1. Short-term notes receivable are loans to other companies. During the year, the company collected the balance outstanding at December 31, 2023, and made new loans in the amount of $14,000.

2. Equipment was sold during the year. This equipment cost $15,000 originally and had a carrying amount of $10,000 at the time of sale.

3. Equipment costing $10,000 was purchased in exchange for a $10,000 note payable.

4. Depreciation expense is included in operating expenses.

5. Accounts receivable are from the sale of merchandise on credit.

6. Accounts payable relate to the purchase of merchandise on credit.

Instructions

a. Prepare a cash flow statement for the year using the indirect method.

b. Prepare the operating section of the cash flow statement using the direct method.

Oakley Ltd. had a relatively small change in its cash balance in 2024; cash decreased by only $1,000. Is it still necessary or important to prepare a cash flow statement? Explain.

Step by Step Answer:

Accounting Principles Volume 2

ISBN: 9781119786634

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak