Please refer to Case 4.30 on pages 134?135 for the financial statement data needed for the analysis

Question:

Please refer to Case 4.30 on pages 134?135 for the financial statement data needed for the analysis of this case. You should also review the solution to Case 4.30, provided by your instructor, before attempting to complete this case.

Required:

a. Case 4.30 presents the 2019 income statement and balance sheet for Gerrard Construction Co. What other financial statements are required? What information would these statements communicate that could not be determined by reviewing only the income statement and balance sheet?

b. Briefly describe the note disclosures that should be provided by Gerrard Construction Co., and explain why note disclosures are considered an integral part of the financial statements.

c. Assume that the balance of ?Accounts Receivable, net? at December 31, 2018, was $24,600. Calculate the following activity measures for Gerrard Construction Co. for the year ended December 31, 2019:

1. Accounts receivable turnover.

2. Number of days? sales in accounts receivable.

d. Calculate the following financial leverage measures for Gerrard Construction Co. at December 31, 2019:

1. Debt ratio.

2. Debt/equity ratio.

e. Gerrard Construction Co. wishes to lease some new earthmoving equipment from Caterpillar on a long-term basis. What impact (increase, decrease, or no effect) would a financing lease of $12 million have on the company?s debt ratio and debt/equity ratio? (Note: These items were computed in part d and do not need to be recomputed for this requirement.)

f. Review the answer to Case 4.30 part i at this time. Assume that Gerrard Construction Co. had 4,800,000 shares of $1 par value common stock outstanding throughout 2019, and that the market price per share of common stock at December 31, 2019, was $57.50. Calculate the following profitability measures for the year ended December 31, 2019:

1. Earnings per share of common stock.

2. Price/earnings ratio.

3. Dividend yield.

4. Dividend payout ratio.

Case 4.30

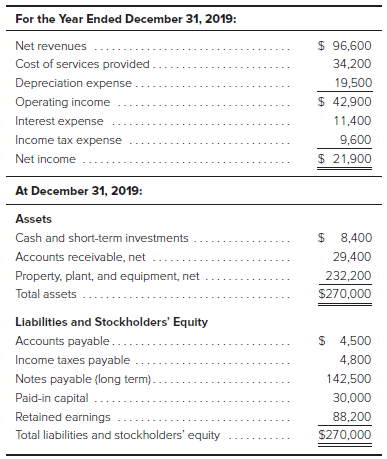

Gerrard Construction Co. is an excavation contractor. The following summarized data (in thousands) are taken from the December 31, 2019, financial statements:

At December 31, 2018, total assets were $246,000 and total stockholders? equity was $97,800. There were no changes in notes payable or paid-in capital during 2019.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Common Stock

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their... Par Value

Par value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,...

Step by Step Answer:

Accounting What the Numbers Mean

ISBN: 978-1260565492

12th edition

Authors: David Marshall, Wayne McManus, Daniel Viele