Holmes Corporation has filed a voluntary petition with the bankruptcy court in hopes of reorganizing. A statement

Question:

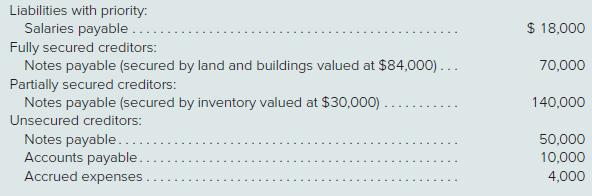

Holmes Corporation has filed a voluntary petition with the bankruptcy court in hopes of reorganizing. A statement of financial affairs has been prepared for the company showing these debts:

Holmes has 10,000 shares of common stock outstanding with a par value of $5 per share. In addition, it is currently reporting a deficit balance of $132,000.

Company officials have proposed the following reorganization plan:

∙ The company’s assets have a total book value of $210,000, an amount considered to be equal to fair value. The reorganization value of the assets as a whole, though, is set at $225,000.

∙ Employees will receive a one-year note in lieu of all salaries owed. Interest will be 10 percent, a normal rate for this type of liability.

∙ The fully secured note will have all future interest dropped from a 15 percent rate, which is now unrealistic, to a 10 percent rate.

∙ The partially secured note payable will be satisfied by signing a new 6-year $30,000 note paying 10 percent annual interest. In addition, this creditor will receive 5,000 new shares of Holmes’s common stock.

∙ An outside investor has been enlisted to buy 6,000 new shares of common stock at $6 per share.

∙ The unsecured creditors will be offered 20 cents on the dollar to settle the remaining liabilities.

If this plan of reorganization is accepted and becomes effective, what journal entries would Holmes Corporation record?

Step by Step Answer:

Advanced Accounting

ISBN: 978-1259444951

13th edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupni