The management of Advanced Alternative Power Inc. is considering two capital investment projects. The estimated net cash

Question:

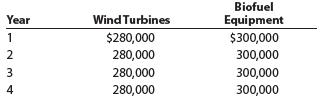

The management of Advanced Alternative Power Inc. is considering two capital investment projects. The estimated net cash flows from each project are as follows:

The wind turbines require an investment of $887,600, while the biofuel equipment requires an investment of $911,100. No residual value is expected from either project.

Instructions

1. Compute the following for each project:

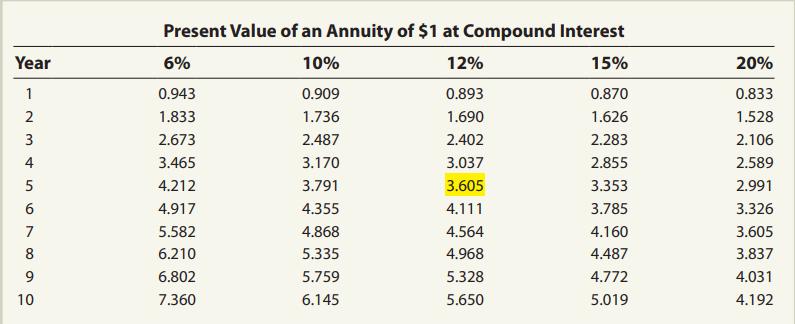

a. The net present value. Use a rate of 6% and the present value of an annuity of $1 table appearing in this chapter (Exhibit 5).

b. A present value index. Round to two decimal places.

2. Determine the internal rate of return for each project by (a) computing a present value factor for an annuity of $1 and (b) using the present value of an annuity of $1 table appearing in this chapter (Exhibit 5).

3. What advantage does the internal rate of return method have over the net present value method in comparing projects?

Exhibit 5:

Step by Step Answer:

Accounting

ISBN: 978-1285743615

26th edition

Authors: Carl S. Warren, James M. Reeve, Jonathan Duchac