Under U.S. GAAP, LIFO is an acceptable inventory method. Financial statement information for three companies that use

Question:

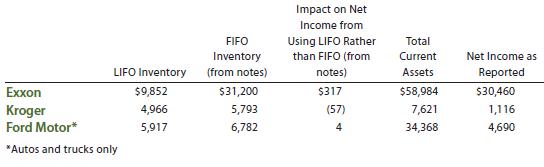

Under U.S. GAAP, LIFO is an acceptable inventory method. Financial statement information for three companies that use LIFO follows. All table numbers are in millions of dollars.

Assume these companies adopted IFRS, and thus were required to use FIFO, rather than LIFO.

a. Prepare a table with the following columns:

![]()

(1) Difference between FIFO and LIFO inventory valuation.

(2) Revised IFRS net income using FIFO.

(3) Difference between FIFO and LIFO inventory valuation as a percent of total current assets.

(4) Revised IFRS net income as a percent of the reported net income.

b. Complete the table for the three companies.

c. For which company would a change to IFRS for inventory valuation have the largest percentage impact on total current assets (Col. 3)?

d. For which company would a change to IFRS for inventory valuation have the largest percentage impact on net income (Col. 4)?

e. Why might Kroger have a negative impact on net income from using LIFO, while the other two companies have a positive impact on net income from using LIFO?

Step by Step Answer:

Accounting

ISBN: 978-1285743615

26th edition

Authors: Carl S. Warren, James M. Reeve, Jonathan Duchac