An entity purchases EUR 20m, 10 per cent five-year government bonds on 1 January 2009 with semi-annual

Question:

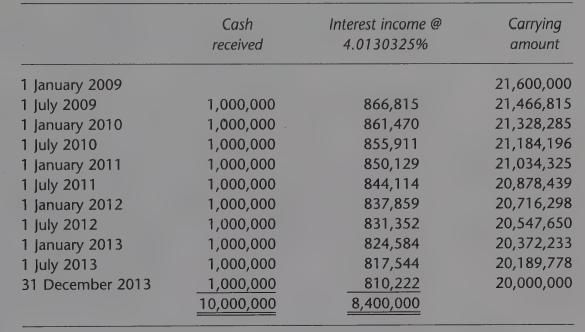

An entity purchases EUR 20m, 10 per cent five-year government bonds on 1 January 2009 with semi-annual interest payable on 30 June and 31 December for EUR 21.6m that results in a premium of EUR 1.6m. The entity classifies the bonds as held-to-maturity investments at amortised cost. The amortisation of the bonds to maturity using the effective interest method is shown below:

On 1 July 2010, the entity sells the bonds at its fair value of EUR 21.2m to a third party with an agreement to repurchase the bonds on 1 July 2011 for EUR 213m.

(a) Does this sale qualify for derecognition? If so, how would you account for it?

(b) Suppose now that the repurchase contract is to be settled net in cash and that the fair value of the asset at the date of repurchase amounts to EUR 21.31m (i.e. the entity will pay an additional EUR 10,000 to the bank). How would your answer to question (a) change?

Step by Step Answer:

Advanced Financial Accounting An International Approach

ISBN: 9780273712749

1st Edition

Authors: Jagdish Kothari, Elisabetta Barone