Brian Construction Company has the following stockholders equity on January 1, 2015, the date on which Roller

Question:

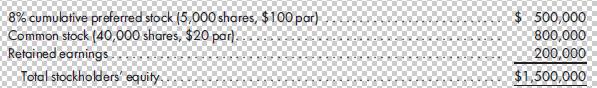

Brian Construction Company has the following stockholders’ equity on January 1, 2015, the date on which Roller Company purchases an 80% interest in the common stock for $720,000:

Brian Construction Company did not pay preferred dividends in 2014.

1. Prepare a determination and distribution of excess schedule. Assume that the preferred stock’s liquidation value is equal to par and that any excess of cost is attributable to goodwill.

2. Assume Ace Construction has the following net income (loss) for 2015 and 2016 and does not pay any dividends:

![]()

Roller maintains its investment account under the cost method. Prepare the cost-to-equity conversion entries necessary on Roller Company’s books to adjust its investment account to the simple equity balance as of January 1, 2017.

Step by Step Answer:

Advanced Accounting

ISBN: 978-1305084858

12th edition

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng