Co X was incorporated on 1 January 20x0. Details of assets and liabilities of Co X as

Question:

Co X was incorporated on 1 January 20x0. Details of assets and liabilities of Co X as at 31 December 20x1 were as follows:

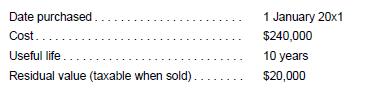

(a) Fixed assets

Depreciation is on a straight line basis. The capital allowances are as follows:

(i) $80,000 in 20x1 (ii) $80,000 in 20x2 (iii) $80,000 in 20x3

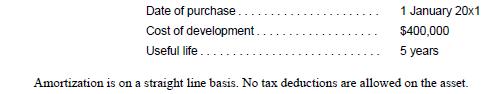

(b) Intangible asset

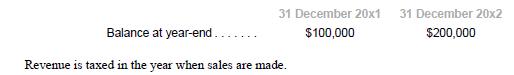

(c) Accounts receivable

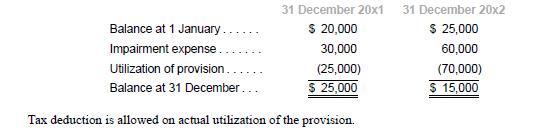

(d) Provision for impairment losses

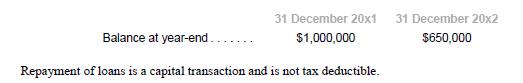

(e) Loan payable

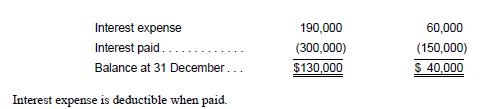

(f) Interest payable

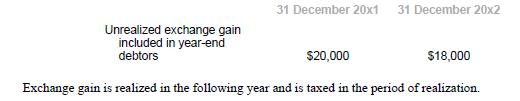

(g) Unrealized exchange gain

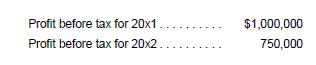

(h) Profit before tax

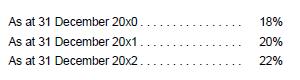

(i) Tax rates

Required

1. Prepare the tax computation for the years ended 31 December 20x1 and 20x2.

2. Using the balance sheet liability approach, and showing the carrying amount and the tax base for each asset and liability above, determine the deferred tax liability balance as at:

(a) 31 December 20x0.

(b) 31 December 20x1; and

(c) 31 December 20x2.

3. Show the journal entries to record tax expense.

4. Show the analytical check on tax expense for 20x1 and 20x2.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah