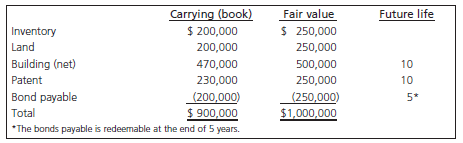

Company Granite purchased 80% of Company Marble on January 1, 20X1, for $700,000, when the net book

Question:

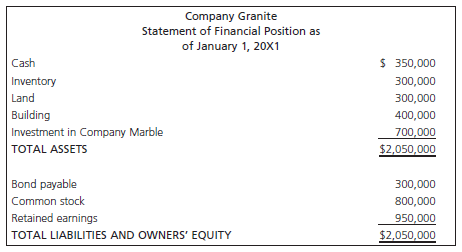

All amortization is charged on a straight-line basis. The retained earnings of Company Marble on the date of acquisition were $400,000. The separate entity SFP of Granite on January 1, 20X1, after the acquisition is provided below:

During 20X1, Marble sold inventory costing $100,000 to Granite for $150,000. Half of the inventory purchased from Marble remained unsold in the inventory of Granite at the end of 20X1. The remaining inventory was sold to an outside party by Granite in 20X2.

During 20X1, Marble sold land costing $100,000 to Granite for $150,000. This land remains unsold with Granite at the end of 20X2.

In 20X2, Granite sold goods costing $80,000 to Marble for $120,000. One-quarter of the inventory purchased from Granite during 20X2 remained unsold in the ending inventory of Marble at the end of 20X2.

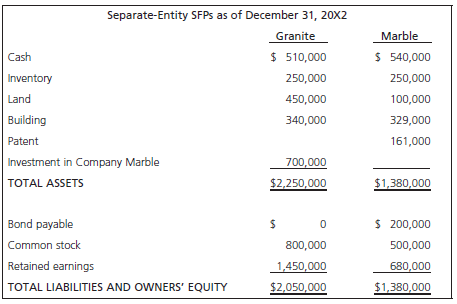

The separate-entity balance sheets of Company Granite and Company Marble as at December 31, 20X2, are provided below.

Required

a. Provide the consolidated balance sheet on the date of acquisition under proportional consolidation.

b. Provide the following SFP consolidated amounts on December 31, 20X2, under the entity method:

i. Consolidated retained earnings; and

ii. Non-controlling interest balance.

Provide the adjusted net incomes of Granite and Marble, respectively, for 20X2 if the separate entity net incomes of Granite and Marble in 20X2 were $150,000 and $120,000, respectively, and Marble paid dividends of $30,000 in 20X2.

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay