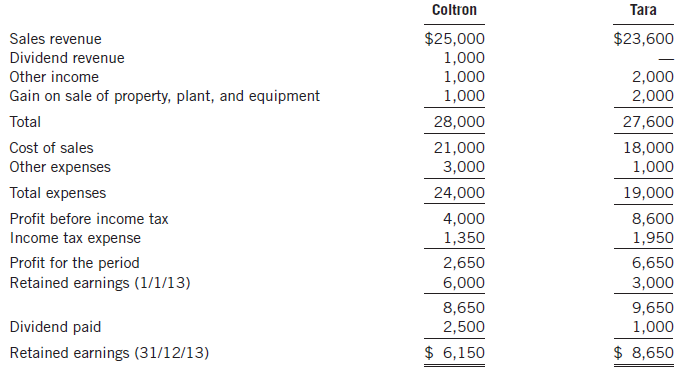

Financial information for Coltron and its 100% owned subsidiary, Tara, for the year ended December 31, 2013,

Question:

Financial information for Coltron and its 100% owned subsidiary, Tara, for the year ended December 31, 2013, is provided below:

Coltron acquired its shares in Tara on January 1, 2013, buying the 10,000 shares for $20,000. Tara recorded share capital of $10,000. The shares were bought on a cum div. basis as Tara had declared a dividend of $3,000 that was not paid until March 2013.

At January 1, 2013, all identifi able assets and liabilities of Tara were recorded at fair value except for inventory, for which the carrying amount of $2,000 was $400 less than fair value. Some of this inventory has been a little slow to sell, and 10% of it was still on hand at December 31, 2013. Inventory on hand in Tara at December 31, 2013, also includes some items acquired from Coltron during the year. These were sold by Coltron for $5,000, at a profi t before tax of $1,000. Half the goodwill was written off as the result of an impairment test on December 31, 2013.

During March 2013, Coltron provided some management services to Tara at a fee of $500.

On July 1, 2013, Tara sold machinery to Coltron at a gain of $2,000. This machinery had a carrying amount to Tara of $20,000, and was considered by Coltron to have a fi ve-year life.

By December 31, 2013, the fi nancial assets acquired by Coltron and Tara increased by $1,000 and $650, respectively. The tax rate is 30%.

Required

(a) Prepare the consolidated statement of comprehensive income for Coltron and its subsidiary, Tara, at December 31, 2013.

(b) Discuss the concept of “realization” using the intragroup transactions in this question to illustrate the concept.

Goodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of...

Step by Step Answer: