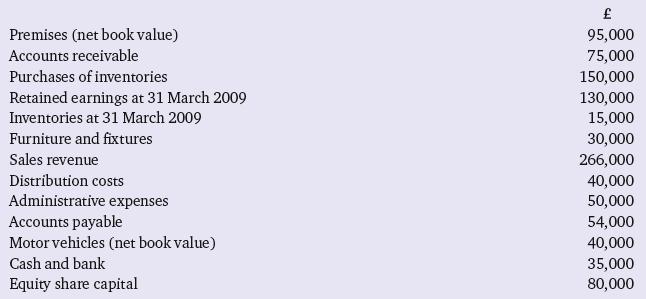

From the trial balance of Retepmal Ltd on 31 March 2010 shown below prepare an income statement

Question:

From the trial balance of Retepmal Ltd on 31 March 2010 shown below prepare an income statement for the year to 31 March 2010 and a balance sheet as of 31 March 2010 using the formats used by most UK companies.

Additional information:

(a) Inventories at 31 March 2010 were £25,000.

(b) Dividend proposed for 2010 was £7,000.

(c) An accrual for distribution costs of £3,000 was required on 31 March 2010.

(d) A prepayment of administrative expenses of £5,000 was required on 31 March 2010.

(e) Corporation tax estimated to be payable on 2009/2010 profit was £19,000.

(f) Annual depreciation charges on-premises and motor vehicles for the year to 31 March 2010 are included in administrative expenses and distribution costs, and in the cumulative depreciation provisions used to calculate the net book values of £95,000 and £40,000 respectively, shown in the trial balance at 31 March 2010.

The furniture and fixtures balance of £30,000 relates to purchases of assets during the year to 31 March 2010. The depreciation charge in administrative expenses and the corresponding depreciation provision are not included in the trial balance on 31 March 2010. They are required to be calculated on a straight-line basis for a full year to 31 March 2010, based on a useful economic life of eight years and an estimated residual value of £6,000.

Step by Step Answer: