In preparing its consolidated financial statements at December 31, 20X7, the following consolidation entries were included in

Question:

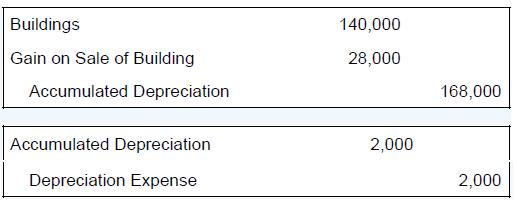

In preparing its consolidated financial statements at December 31, 20X7, the following consolidation entries were included in the consolidation worksheet of Powder Corporation:

Required

a. What amount did Powder pay Snow for the building?

b. What amount of accumulated depreciation did Snow report at January 1, 20X7, prior to the sale?

c. What annual depreciation expense did Snow record prior to the sale?

d. What expected residual value did Snow use in computing its annual depreciation expense?

e. What amount of depreciation expense did Powder record in 20X7?

f. If Snow reported net income of $80,000 for 20X7, what amount of income will be assigned to the noncontrolling interest in the consolidated income statement for 20X7?

g. If Snow reported net income of $65,000 for 20X8, what amount of income will be assigned to the noncontrolling interest in the consolidated income statement for 20X8?

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd