Lucy Company issues securities with a fair value of $468,000 for a 90% interest in Diamond Company

Question:

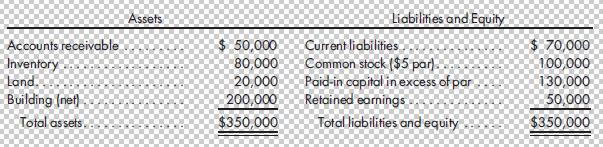

Lucy Company issues securities with a fair value of $468,000 for a 90% interest in Diamond Company on January 1, 2015, at which time Diamond Company has the following balance sheet:

It is believed that the inventory and the building are undervalued by $20,000 and $50,000, respectively. The building has a 10-year remaining life; the inventory on hand on January 1, 2015, is sold during the year. The deferred tax liability associated with the asset revaluations is to be reflected in the consolidated statements. Each company has an income tax rate of 30%. Any remaining excess is goodwill.

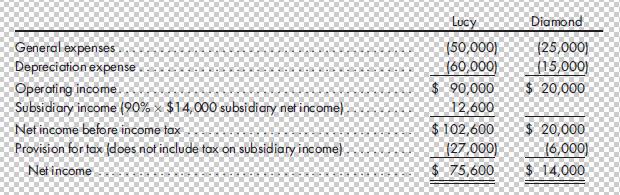

The separate income statements of the two companies prepared for 2015 are as follows:

1. Prepare a value analysis and a determination and distribution of excess schedule for the investment.

2. Prepare the 2015 consolidated income statement and its related income distribution schedules.

Step by Step Answer:

Advanced Accounting

ISBN: 978-1305084858

12th edition

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng