On 1 March 20x3, East-West Airlines Inc purchased an at-the-money call option on 100,000 barrels of jet-fuel

Question:

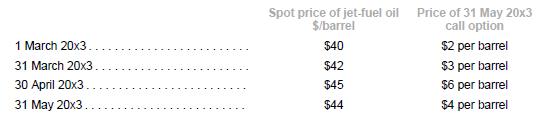

On 1 March 20x3, East-West Airlines Inc purchased an at-the-money call option on 100,000 barrels of jet-fuel oil with an exercise price of $40 per barrel for delivery on 31 May 20x3. East-West paid a premium of $200,000 for the call option. The following are the quoted spot prices for the jet-fuel oil and the call option from 1 March 20x3 to 31 May 20x3.

The option contract was to hedge against the forecasted purchase of 100,000 barrels of jet-fuel oil on 31 May 20x3. The option contract was an effective hedge as the critical terms matched and the time value of the option contract was excluded from the hedging relationship. The contract would be settled on a net basis. East-West Airlines Inc’s financial year-end is 30 April.

Required

1. Calculate the time value and the intrinsic value of the option contract on 31 March 20x3, 30 April 20x3 and 31 May 20x3.

2. Prepare the journal entries relating to the hedging instrument.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah