Paste Corporation acquired 70 percent of Stick Companys stock on January 1, 20X9, for $105,000. At that

Question:

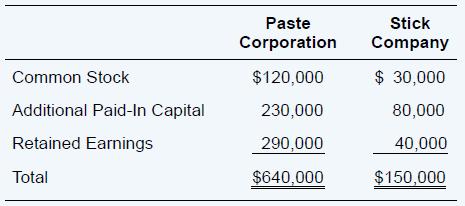

Paste Corporation acquired 70 percent of Stick Company’s stock on January 1, 20X9, for $105,000. At that date, the fair value of the noncontrolling interest was equal to 30 percent of the book value of Stick Company. The companies reported the following stockholders’ equity balances immediately after the acquisition:

Paste and Stick reported 20X9 operating incomes of $90,000 and $35,000 and dividend payments of $30,000 and $10,000, respectively.

Required

a. Compute the amount reported as net income by each company for 20X9, assuming Paste uses equity-method accounting for its investment in Stick.

b. Compute consolidated net income for 20X9.

c. Compute the reported balance in retained earnings at December 31, 20X9, for both companies.

d. Compute consolidated retained earnings at December 31, 20X9.

e. How would the computation of consolidated retained earnings at December 31, 20X9, change if Paste uses the cost method in accounting for its investment in Stick?

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd