Pillow Company holds 70 percent of the common shares of Sheet Corporation. Trial balances for the two

Question:

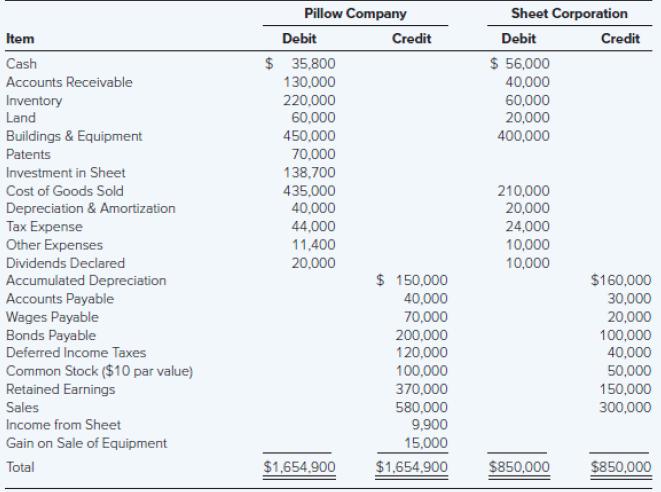

Pillow Company holds 70 percent of the common shares of Sheet Corporation. Trial balances for the two companies on December 31, 20X7, are as follows:

At the beginning of 20X7, Pillow held inventory purchased from Sheet containing unrealized profits of $10,000. During 20X7, Pillow purchased $120,000 of inventory from Sheet and on December 31, 20X7, had goods on hand containing $25,000 of unrealized intercompany profit. On December 31, 20X7, Pillow sold equipment to Sheet for $65,000. Pillow had purchased the equipment for $150,000 and had accumulated depreciation of $100,000 on it at the time of sale. The companies file separate tax returns and are subject to a 40 percent income tax rate on all taxable income. Intercompany dividends are 80 percent exempt from taxation.

Required

a. Prepare all consolidation entries needed as of December 31, 20X7, to prepare consolidated financial statements for Pillow Company and its subsidiary.

b. Prepare a consolidation worksheet for 20X7.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd