Plant Advertising Corporation acquired 60 percent of Seed Manufacturing Companys shares on December 31, 20X1, at underlying

Question:

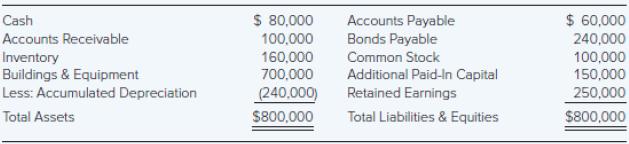

Plant Advertising Corporation acquired 60 percent of Seed Manufacturing Company’s shares on December 31, 20X1, at underlying book value of $180,000. At that date, the fair value of the noncontrolling interest was equal to 40 percent of the book value of Seed Manufacturing. Seed’s balance sheet on January 1, 20X7, contained the following balances:

On January 1, 20X7, Seed purchased 2,000 of its own $10 par value common shares from Nonaffiliated Corporation for $42 per share.

Required

a. Compute the change in the book value of the parent’s equity as a result of the repurchase of shares by Seed Manufacturing.

b. Give the entry to be recorded on Plant Advertising’s books to recognize the change in the book value of the shares it holds.

c. Give the consolidation entry needed in preparing a consolidated balance sheet immediately following the purchase of shares by Seed.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd