Point Corporation acquired 60 percent of Stick Companys stock on January 1, 20X3, for $24,000 in excess

Question:

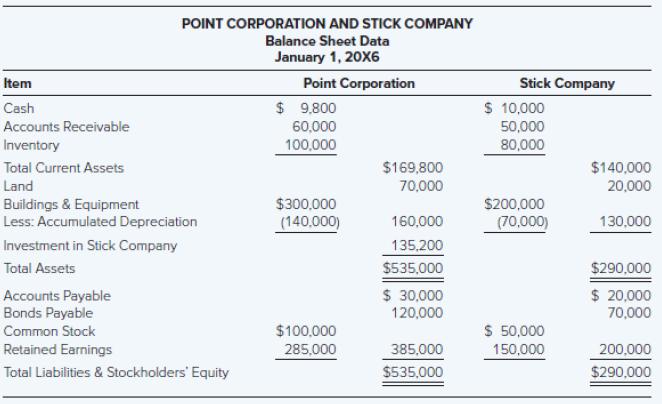

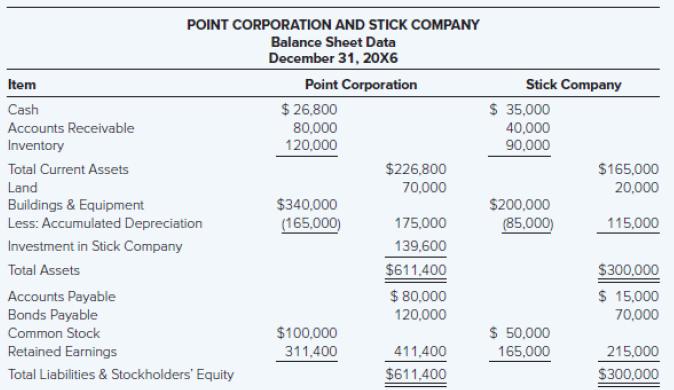

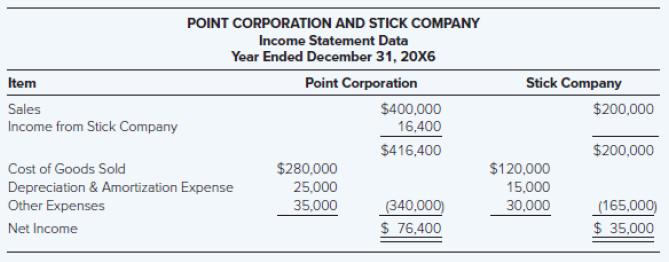

Point Corporation acquired 60 percent of Stick Company’s stock on January 1, 20X3, for $24,000 in excess of book value. On that date, the book values and fair values of Stick’s assets and liabilities were equal and the fair value of the noncontrolling interest was $16,000 in excess of book value. The full amount of the differential at acquisition was assigned to goodwill of $40,000. At December 31, 20X6, Point management reviewed the amount assigned to goodwill and concluded it had been impaired. They concluded the correct carrying value at that date should be $30,000 and the impairment loss should be assigned proportionately between the controlling and noncontrolling interests. Balance sheet data for January 1, 20X6, and December 31, 20X6, and income statement data for 20X6 for the two companies are as follows:

On January 1, 20X6, Point held inventory purchased from Stick for $48,000. During 20X6, Point purchased an additional $90,000 of goods from Stick and held $54,000 of its purchases on December 31, 20X6. Stick sells inventory to Point Corporation at 20 percent above cost. Stick also purchases inventory from Point. On January 1, 20X6, Stick held inventory purchased from Point for $14,000, and on December 31, 20X6, it held inventory purchased from Point for $7,000. Stick’s total purchases from Point were $22,000 in 20X6. Point sells items to Stick at 40 percent above cost.

During 20X6, Point paid dividends of $50,000, and Stick paid dividends of $20,000. Assume that Point uses the fully adjusted equity method that both companies use straight-line depreciation, and that no property, plant, and equipment has been purchased since the acquisition.

Required

a. Prepare all consolidation entries needed to complete a consolidation worksheet as of December 31, 20X6.

b. Prepare a three-part consolidation worksheet as of December 31, 20X6.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd