Prince Corporation holds 75 percent of the common stock of Sword Distributors Inc., purchased on December 31,

Question:

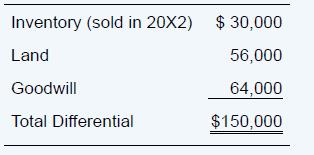

Prince Corporation holds 75 percent of the common stock of Sword Distributors Inc., purchased on December 31, 20X1, for $2,340,000. At the date of acquisition, Sword reported common stock with a par value of $1,000,000, additional paid-in capital of $1,350,000, and retained earnings of $620,000. The fair value of the noncontrolling interest at acquisition was $780,000. The differential at acquisition was attributable to the following items:

During 20X2, Prince sold a plot of land that it had purchased several years before to Sword at a gain of $23,000; Sword continues to hold the land. In 20X6, Prince and Sword entered into a five-year contract under which Prince provides management consulting services to Sword on a continuing basis; Sword pays Prince a fixed fee of $80,000 per year for these services. At December 31, 20X8, Sword owed Prince $20,000 as the final 20X8 quarterly payment under the contract. On January 2, 20X8, Prince paid $250,000 to Sword to purchase equipment that Sword was then carrying at $290,000. Sword had purchased that equipment on December 27, 20X2, for $435,000. The equipment is expected to have a total 15-year life and no salvage value. The amount of the differential assigned to goodwill has not been impaired.

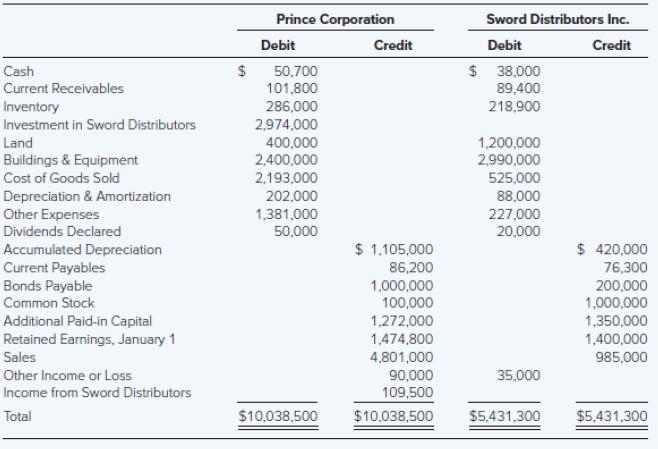

At December 31, 20X8, trial balances for Prince and Sword appeared as follows:

As of December 31, 20X8, Sword had declared but not yet paid its fourth-quarter dividend of $5,000. Both companies use straight-line depreciation and amortization. Prince uses the fully adjusted equity method to account for its investment in Sword.

Required

a. Compute the amount of the differential as of January 1, 20X8.

b. Verify the balance in Prince’s Investment in Sword Distributors account as of December 31, 20X8.

c. Present all consolidation entries that would appear in a three-part consolidation worksheet as of December 31, 20X8.

d. Prepare and complete a three-part worksheet for the preparation of consolidated financial statements for 20X8.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd