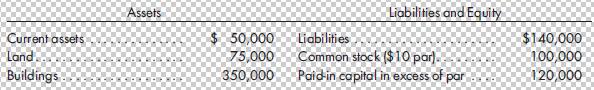

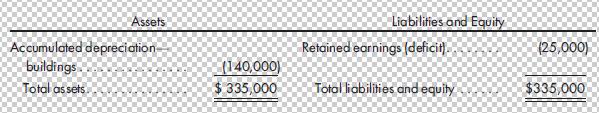

Sandin Company prepares the following balance sheet on January 1, 2015: On this date, Prescott Company purchases

Question:

Sandin Company prepares the following balance sheet on January 1, 2015:

On this date, Prescott Company purchases 8,000 shares of Sandin Company’s outstanding stock for a total price of $270,000. Also on this date, the buildings are understated by $40,000 and have a 10-year remaining life. Any remaining discrepancy between the price paid and book value is attributed to goodwill. Since the purchase, Prescott Company has used the simple equity method to record the investment and its related income.

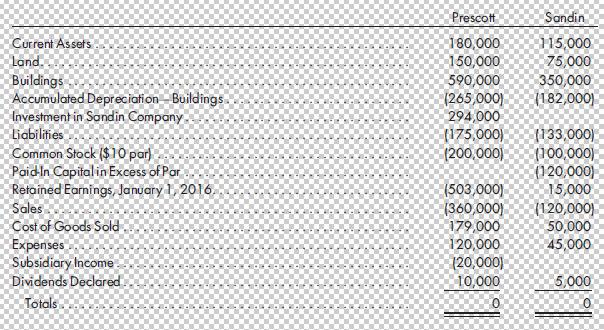

Prescott Company and Sandin Company prepare the following separate trial balances on December 31, 2016:

Required

1. Prepare a value analysis and a determination and distribution of excess schedule for the investment.

2. Prepare the 2016 consolidated worksheet. Include columns for the eliminations and adjustments, the consolidated income statement, the NCI, the controlling retained earnings, and the consolidated balance sheet. Prepare supporting income distribution schedules.

3. Prepare the 2016 consolidated statements including the income statement, retained earnings statement, and the balance sheet.

Step by Step Answer:

Advanced Accounting

ISBN: 978-1305084858

12th edition

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng