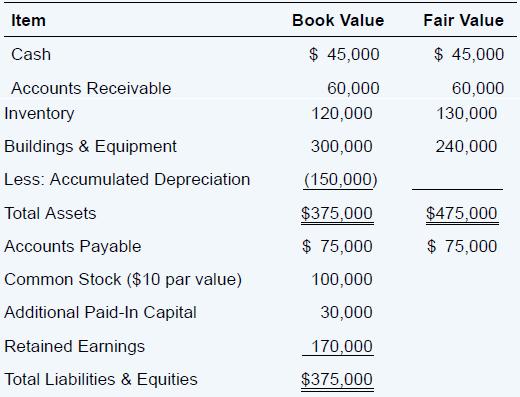

Softball Corporation reported the following balances at January 1, 20X9: On January 1, 20X9, Pitcher Corporation purchased

Question:

Softball Corporation reported the following balances at January 1, 20X9:

On January 1, 20X9, Pitcher Corporation purchased 100 percent of Softball’s stock. All tangible assets had a remaining economic life of 10 years at January 1, 20X9. Both companies use the FIFO inventory method. Softball reported net income of $16,000 in 20X9 and paid dividends of $3,200. Pitcher uses the equity method in accounting for its investment in Softball.

Required

Give all journal entries that Pitcher recorded during 20X9 with respect to its investment assuming Pitcher paid $437,500 for the ownership of Softball on January 1, 20X9. The amount of the differential assigned to goodwill is not impaired.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd