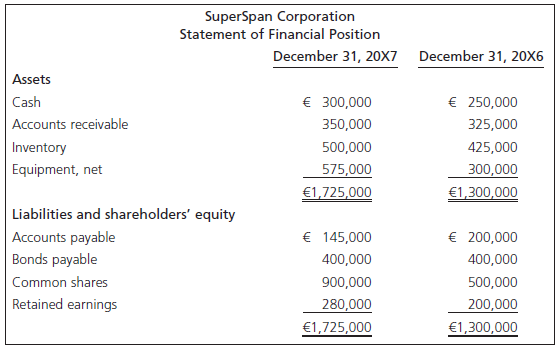

SuperSpan Corporation is a foreign subsidiary of Port Corporation, a Canadian company. SuperSpan was acquired on January

Question:

Additional Information

1. The following exchange rates were noted:

January 1, 20X1.......................................................................‚¬1 = C$1.55

January 1, 20X6.......................................................................‚¬1 = C$1.52

Average for October 1€“December 31, 20X6.......................‚¬1 = C$1.48

Average for 20X6....................................................................‚¬1 = C$1.50

December 31, 20X6................................................................‚¬1 = C$1.45

July 1, 20X7..............................................................................‚¬1 = C$1.44

Average for October 1€“December 31, 20X7.......................‚¬1 = C$1.43

November 1, 20X7..................................................................‚¬1 = C$1.41

Average for 20X7....................................................................‚¬1 = C$1.42

December 31, 20X7................................................................‚¬1 = C$1.40

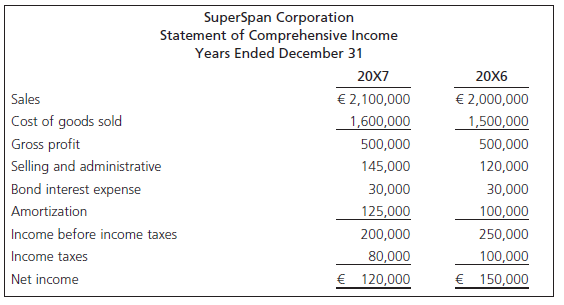

2. On January 1, 20X1, SuperSpan acquired equipment for ‚¬900,000 with an expected useful life of nine years. On July 1, 20X7, it acquired ‚¬400,000 of new equipment with an expected useful life of eight years. SuperSpan amortizes its equipment on a straight-line basis, calculated monthly.

3. SuperSpan partly financed its acquisition of equipment on January 1, 20X1, by issuing ‚¬400,000, eight-year, 5% bonds payable. Similarly, SuperSpan financed its acquisition of equipment in 20X7 by issuing ‚¬400,000 of common shares on July 1, 20X7.

4. Inventory on hand on December 31, 20X6, and December 31, 20X7, includes a significant amount of wood imported from western Canadian timber firms. It was purchased evenly over the last three months of 20X6 and 20X7.

5. Dividends of ‚¬40,000 were declared and paid on November 1, 20X7. No dividends were paid in 20X6.

6. All other sales, purchases, and expenses occurred evenly each year.

Required

a. Should SuperSpan€™s financial statements be translated into Canadian dollars using the temporal method or the current-rate method? Provide two facts from the question to support your answer.

b. Disregard your response to part a). Using the current-rate method, translate SuperSpan€™s 20X7 financial statements into Canadian dollars.

c. Disregard your responses to parts a) and b). Using the temporal method, translate SuperSpan€™s 20X7 financial statements into Canadian dollars. (The retained earnings of ‚¬200,000 on December 31, 20X6, should be translated as $288,750.)

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay