The accountant of Kops Ltd has just prepared the financial statements for the financial year ended 31

Question:

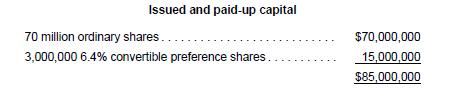

The accountant of Kops Ltd has just prepared the financial statements for the financial year ended 31 December 20x4. The income statement reported a consolidated profit after tax of $14,500,000 ($12,800,000 for fiscal year 20x3). The statement of financial position as at 31 December 20x4 shows the following capital structure:

Additional information

(a) On 1 July 20x3, Kops Ltd made a one-for-two rights issue at a subscription price of $1.00. The market price of Kops Ltd's share just before it went ex-rights was $1.90 per share.

(b) On 1 April 20x4, there was a one-for-one bonus issue of ordinary shares.

(c) The convertible preference shares were issued on 1 October 20x3. The preference shares were convertible into ordinary shares on the basis of two ordinary shares for each preference share after the bonus issue. On 1 July 20x4, 1,000,000 preference shares were converted into ordinary shares. Preference dividends (tax-exempt)

were paid on the shares outstanding at the end of each quarter in 20x3 and 20x4.

(d) On 1 October 20x4, the company issued 8,000,000 ordinary shares of $1 each as purchase consideration for a commercial building. The shares were issued at full market price.

Required

1. Show the capital structure of Kops Ltd at 1 January 20x3.

2. Calculate the earnings per share of Kops Ltd for 20x3 and for 20x4 (with comparative figures for 20x3).

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah