The following information appeared in the footnote disclosure to the 20x1 annual report of SG Company Ltd.

Question:

The following information appeared in the footnote disclosure to the 20x1 annual report of SG Company Ltd.

The company has introduced a share appreciation rights plan on 1 January 20x1, whereby 100,000 share appreciation rights (SARS) are given to ten of our managers. Under this plan, each manager is entitled to receive cash based on the increase in the company’s share price from 1 January 20x1 to 31 December 20x2 provided they remain in the company’s employment at 31 December 20x2.

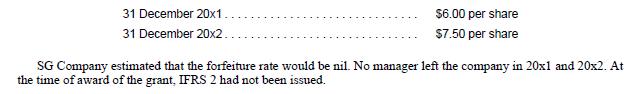

On 1 January 20x1, the share price of SG Company Ltd was $5 per share. The share prices of SG Company subsequent to the grant were as follows:

Required

Discuss how SG Company Ltd should account for the share appreciation rights assuming that IFRS 2 had been adopted in 20x1 and 20x2. Ignore tax effects.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah