The separate income statements of Danner Company and its 90%-owned subsidiary, Link Company, for the year ended

Question:

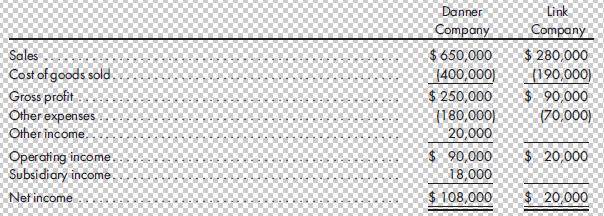

The separate income statements of Danner Company and its 90%-owned subsidiary, Link Company, for the year ended December 31, 2016, are as follows:

The following additional facts apply:

a. On January 1, 2015, Link Company purchased a building, with a book value of $100,000 and an estimated 20-year life, from Danner Company for $150,000. The building was being depreciated on a straight-line basis with no salvage value.

b. On January 1, 2016, Link Company sold a machine with a cost of $40,000 to Danner Company for $60,000. The machine had an expected life of five years and is being depreciated on a straight-line basis with no salvage value. Link Company is a dealer for the machine.

Prepare a worksheet that shows income statements of Danner and Link with a column for eliminations. Be sure to include the distribution of income to the controlling and non-controlling interest.

Step by Step Answer:

Advanced Accounting

ISBN: 978-1305084858

12th edition

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng