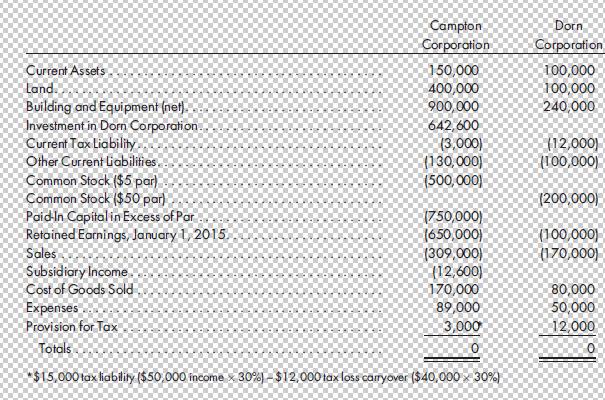

The trial balances of Campton Corporation and Dorn Corporation as of December 31, 2015. On January 1,

Question:

The trial balances of Campton Corporation and Dorn Corporation as of December 31, 2015.

On January 1, 2015, Campton purchases 90% of the outstanding stock of Dorn Corporation for $630,000. The acquisition is a tax-free exchange for the seller. At the purchase date, Dorn’s equipment is undervalued by $100,000 and has a remaining life of 10 years. All other assets have book values that approximate their fair values. Dorn Corporation has a tax loss carryover of $200,000, of which $50,000 is utilizable in 2015 and the balance in future periods. The tax loss carryover is expected to be fully utilized. Any remaining excess is considered to be goodwill. A tax rate of 30% applies to both companies.

Required

1. Prepare a value analysis and a determination and distribution of excess schedule for the investment.

2. Prepare the 2015 consolidated worksheet. Include columns for the eliminations and adjustments, the consolidated income statement, the NCI, the controlling retained earnings, and the consolidated balance sheet. Prepare supporting income distribution schedules as well.

3. Prepare the 2015 consolidated statements, including the income statement, retained earnings statement, and balance sheet.

Suggestion: A deferred tax liability results from the increase in the fair value of the equipment. As the added depreciation is recognized on the equipment, the deferred tax liability becomes payable. Note that income distribution schedules record net-of-tax income. Therefore, be sure that any adjustments to the income distribution schedules consider tax where appropriate.

Step by Step Answer:

Advanced Accounting

ISBN: 978-1305084858

12th edition

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng