Using the same fact pattern as in P8.18 . Instead of disposing 70% of the Singapore subsidiary,

Question:

Using the same fact pattern as in P8.18 . Instead of disposing 70% of the Singapore subsidiary, the US parent company sells 10% of its shareholding interests to a third party for US$4,500,000. The US parent company continues to retain control over the Singapore subsidiary post-disposal.

Calculate the gain or loss on disposal and prepare the accounting entries in the separate and consolidated financial statements.

Data from P8.18

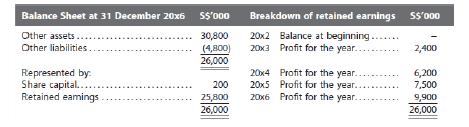

An US parent company with functional and presentation currency of US$ has a wholly owned Singapore subsidiary, which it incorporated in 20x2. The share capital of the Singapore subsidiary at the date of incorporation is S$200,000 and the exchange rate on that date is 1.55. On 31 December 20x6, the US parent sells 70% interest to a third party at cash consideration of US$8 million. Control over the Singapore subsidiary was lost upon the disposal. The financial position of the Singapore subsidiary at the date of disposal and the relevant exchange rates are set out as follows

The fair value of the retained interests of 30% as at the date of disposal is $10,500.

Calculate the gain or loss on disposal and prepare the accounting entries for the transaction. Ignore the effects of taxes.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah