Whitney Company acquires an 80% interest in Masters Company common stock on January 1, 2015. Appraisals of

Question:

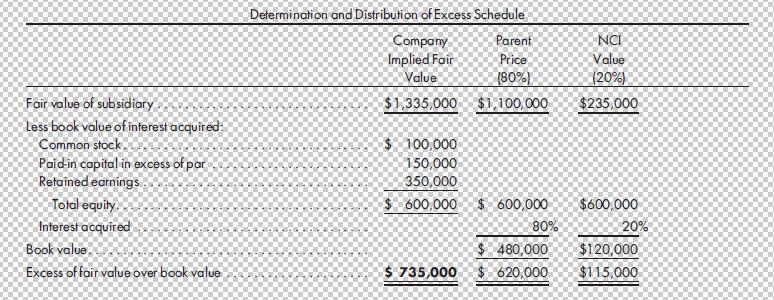

Whitney Company acquires an 80% interest in Masters Company common stock on January 1, 2015. Appraisals of Masters’ assets and liabilities are performed, and Whitney ends up paying an amount that is greater than the fair value of Masters’ net assets and reflects a premium to achieve control. The fair value of the NCI is $235,000. The following partial determination and distribution of excess schedule is created on January 1, 2015, to assist in putting together the consolidated financial statements:

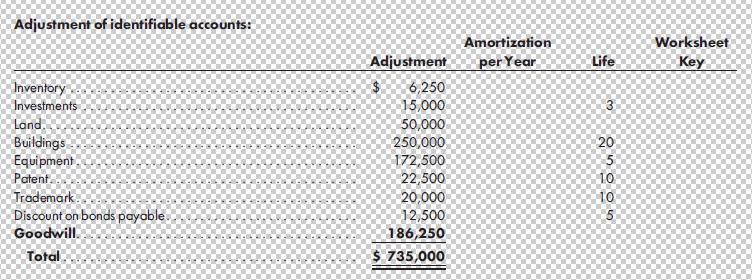

Prepare amortization schedules for the years 2015, 2016, 2017, and 2018.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Advanced Accounting

ISBN: 978-1305084858

12th edition

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng

Question Posted: