Your friend is a financial analyst whose accounting knowledge is virtually nonexistent. Your friend believes that financial

Question:

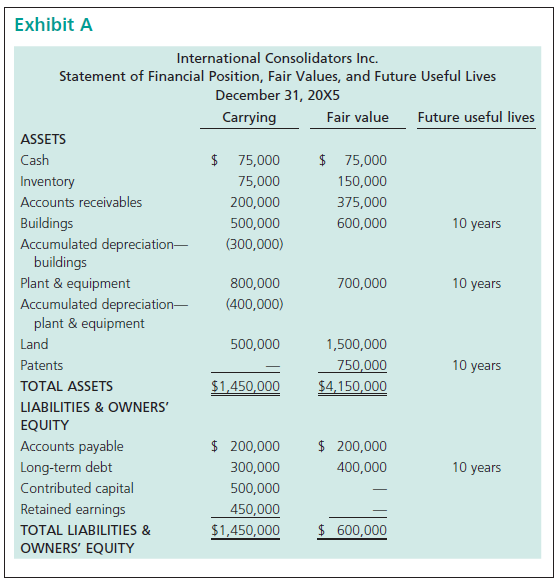

Recently, you met with your friend over coffee and the conversation slowly drifted to his work. He indicated that he had been following the performance of International Consolidators Inc. (ICI). ICI had acquired 80% of the shares of Prime Target Inc. (PTI) on December 31, 20X5, for $3,220,000 by issuing shares. PTI appeared to be an ideal acquisition given that its return on year-end equity was 20.42% for 20X5. The return on equity for ICI on the same basis for 20X5 was 10.69%. The statement of financial position of PTI on December 31, 20X5, the fair values of its identifiable assets and liabilities, and their future useful lives, where applicable, were as shown in Exhibit A:

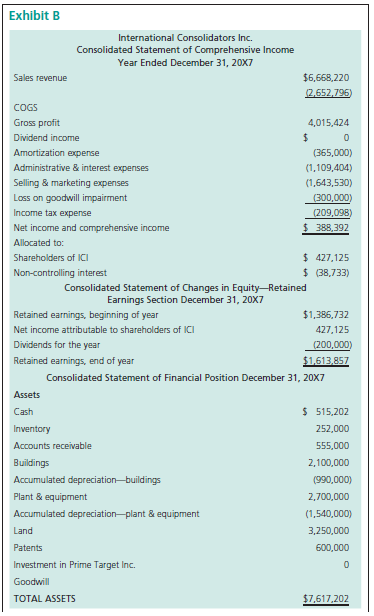

When ICI had acquired its controlling interest in PTI on December 31, 20X5, ICI management had touted the potential synergies between the two companies. It is now the end of 20X7, and your friend is clearly disappointed by the financial results presented in the consolidated financial statements issued by ICI under IFRS for 20X7. Your friend does not see the result of any synergy between the two companies in the consolidated financial statements, as provided in Exhibit B . He notes that the return on total year-end equity is an unimpressive 5.94%. You gently point out to him that he is disregarding the impact of accounting, especially consolidation-related accounting, on these numbers.

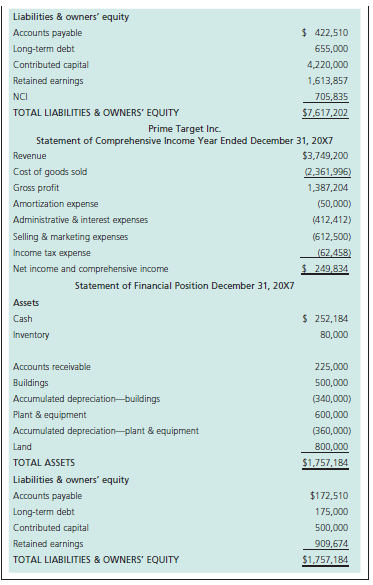

To this your friend counters, €œFair enough. I€™d like for you to show me just what I€™m overlooking. Here are the separate-entity financial statements of PTI for 20X7 and some other information that I€™ve been able to gather about the two companies [Exhibit C]. Would you mind preparing the separate-entity financial statements of ICI

Exhibit C

ADDITIONAL INFORMATION

– On December 31, 20X5, the net identifiable assets of ICI had a fair value that was $2,275,000 greater than their net carrying value.

– Upstream sales from PTI to ICI during 20X7 = $1,499,680. Downstream sales from ICI to PTI during 20X7 = $1,472,900.

– PTI (subsidiary) declared and paid dividends of $50,000 in 20X6 and $60,000 in 20X7.

– ICI (parent) declared and paid dividends of $150,000 in 20X6 and $200,000 in 20X7.

– Inventory purchased from PTI (subsidiary) in ICI€™s (parent) 20X7 beginning inventory = $100,000. Inventory purchased from PTI (subsidiary) in ICI€™s (parent) 20X7 ending inventory = $150,000. PTI sold goods at the same gross profit percentage in both 20X6 and 20X7.

– Inventory purchased from ICI (parent) in PTI€™s 20X7 beginning inventory = $40,000. Inventory purchased from ICI (parent) in PTI€™s (subsidiary) 20X7 ending inventory = $50,000. ICI sold goods at the same gross profit percentage of 45% in both 20X6 and 20X7.

– On January 1, 20X6, PTI sold plant & equipment that on that date had an original cost of $200,000 and carrying value of $100,000 to ICI for $200,000. The plant & equipment also had a future useful life of 10 years on January 1, 20X6.

– PTI (subsidiary) purchased additional land from an outside party for $300,000 on January 1, 20X7.

– Due to impairment in 20X7, the value of goodwill relating to the purchase of PTI was worth $175,000 on December 31, 20X7.

– PTI is the sole subsidiary of ICI.

– Neither company purchased or sold any other buildings, plant and equipment, or land, or issued additional shares since ICI purchased its controlling interest in PTI.

(SCI, SFP, and statement of changes in equity€”retained earnings section) under the cost method for 20X7 based on the information provided? I€™d like to understand how the consolidation process affects ICI€™s financial results. Can you also give me some guidance as to the true economic operating results and financial position of the two companies?€

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay