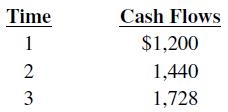

Assume a firm with a book value of $8,000 has the following cash flows: The investment has

Question:

Assume a firm with a book value of $8,000 has the following cash flows:

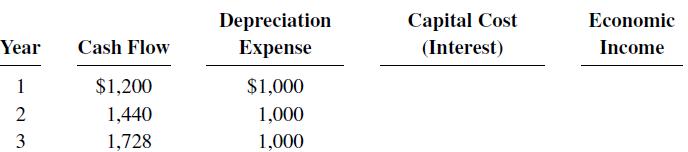

The investment has a 0.20 internal rate of return. There are zero taxes and the firm uses straight-line depreciation of $1,000 per year. At the end of year 3, the value of the firm is expected to be $11,979.

The CFO thinks 0.10 is the correct risk-adjusted discount rate for the investment.

a. Compute economic income of each year.

b. Compute the firm’s present value using 0.10 and the firm’s cash flows.

c. Compute the firm’s present value using 0.10 and the economic incomes and any other relevant information.

d. Are your answers to parts (b) and (c) likely to be correct? Why?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction To Accounting And Managerial Finance A Merger Of Equals

ISBN: 9789814273824

1st Edition

Authors: Harold JR Bierman

Question Posted: