Company F is considering the terms of a convertible bond that it is going to issue. The

Question:

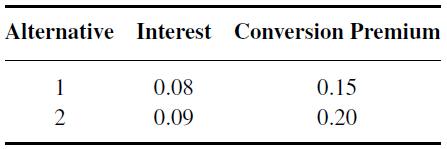

Company F is considering the terms of a convertible bond that it is going to issue. The following facts apply:

The bond issue size is $10 million. The bonds will have a maturity of 10 years and will be noncallable. The tax rate is 0.46. The stock price is $50.

a. How many shares would the bonds be convertible into with the 0.15 premium?

b. How many shares would the bonds be convertibles into with the 0.20 premium?

c. With the 0.20 conversion premium, there is an extra after-tax cost of $________________ per year.

d. What does the price of the common stock have to be at time 10 for alternative 2 to be preferred? Assume the firm has an opportunity cost of money of 0.10.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction To Accounting And Managerial Finance A Merger Of Equals

ISBN: 9789814273824

1st Edition

Authors: Harold JR Bierman

Question Posted: