For a company with zero debt, the cost of the first dollar of debt is 0.10, and

Question:

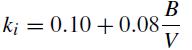

For a company with zero debt, the cost of the first dollar of debt is 0.10, and the cost of common stock is 0.18 (these are returns required by investors).We have determined that the cost of debt is

and that there are no taxes and no bankruptcy costs. The capital market is rational and well informed.

a. What is the weighted average cost of capital?

b. Should the next issue of the company be common stock or debt if the objective is to minimize the cost of the capital?

c. What will be the cost of equity if the capital structure has equal amounts of debt and equity?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction To Accounting And Managerial Finance A Merger Of Equals

ISBN: 9789814273824

1st Edition

Authors: Harold JR Bierman

Question Posted: