Footnote 1 shows that the correct discount rate to use for the real-world expected payoff in the

Question:

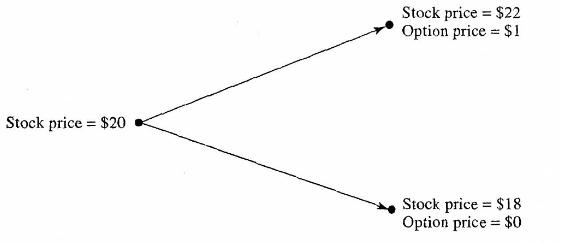

Footnote 1 shows that the correct discount rate to use for the real-world expected payoff in the case of the call option considered in Figure 12.1 is \(42.6 \%\). Show that if the option is a put rather than a call the discount rate is \(-52.5 \%\). Explain why the two real-world discount rates are so different.

Figure 12.1

Transcribed Image Text:

Stock price = $20 Stock price = $22 Option price = $1 Stock price = $18 Option price = $0

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 0% (1 review)

The text you refer to is not shown in the image it is likely from the surrounding text that accompan...View the full answer

Answered By

Hassan Ali

I am an electrical engineer with Master in Management (Engineering). I have been teaching for more than 10years and still helping a a lot of students online and in person. In addition to that, I not only have theoretical experience but also have practical experience by working on different managerial positions in different companies. Now I am running my own company successfully which I launched in 2019. I can provide complete guidance in the following fields. System engineering management, research and lab reports, power transmission, utilisation and distribution, generators and motors, organizational behaviour, essay writing, general management, digital system design, control system, business and leadership.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

CANMNMM January of this year. (a) Each item will be held in a record. Describe all the data structures that must refer to these records to implement the required functionality. Describe all the...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

Planning is one of the most important management functions in any business. A front office managers first step in planning should involve determine the departments goals. Planning also includes...

-

The boundedness theorem shows how the bottom row of a synthetic division is used to place upper and lower bounds on possible real zeros of a polynomial function. Let P(x) define a polynomial function...

-

Calculate the accounts receivable period, accounts payable periods, inventory period, and cash conversion cycle for the following firm. Assume that the following data is from an annual financial...

-

Ensuring inventories include all materials, products, and supplies on hand at the end of the reporting period relates to the audit assertion of: a. accuracy, valuation, and allocation. b....

-

Reconsider Problem 65. Plot a graph of capital recovery cost versus useful life for lives 1 to 25 by 1. Data from problem 65 Crush Autosmashers can purchase a new electromagnet for moving cars at a...

-

Debt Service Fund Trial Balance. Following is Franklin Countys debt service fund pre-closing trial balance for the fiscal year ended June 30, 2011. Required Using information provided by the trial...

-

a) In the conventional theory of the firm, the principal objective of a business is profit maximisation. Under the differences in consumer tastes and technology drive, price and output of a given...

-

Ye Olde Creamery, a popular ice cream store on campus, has one line for its tasty treats. Students arrive at the Creamery about one every minute. Because of the new automated Wave N Pay payment...

-

Consider a variable \(S\) that follows the process For the first three years, \(\mu=2\) and \(\sigma=3\); for the next three years, \(\mu=3\) and \(\sigma=4\). If the initial value of the variable is...

-

What are the formulas for \(u\) and \(d\) in terms of volatility?

-

Find the x-and y-intercepts. Then graph each equation. 2 I y = x 3-

-

Approximately 70 percent of all businesses are sole proprietorships. Why is sole proprietorship a popular form of business ownership? What are the circumstances when it might be important to consider...

-

Before PERT diagrams are prepared, should the person performing the work have a clear definition of the requirements and objectives, both prime and supporting? Is it an absolute necessity?

-

Which of the following describes a security issued by a local government agency? a. Acme, Inc. debenture bond b. Souderton County Water Authority bond c. 10-year Treasury bond d. Fidelity bond fund

-

Pierre and Antoinette produce cellos and double basses. The tables show their production possibilities. Pierre produces 30 cellos and 50 basses a month; Antoinette produces 40 cellos and 10 basses a...

-

At many colleges and universities, the highest paid member of the faculty is an athletic coach. At Duke University in Durham, North Carolina, basketball coach Mike Krzyzewski earned a salary of more...

-

A 1.50 m wire has a mass of 8.70 g and is under a tension of 120 N. The wire is held rigidly at both ends and set into oscillation. (a) What is the speed of waves on the wire? What is the wavelength...

-

The test statistic in the NeymanPearson Lemma and the likelihood ratio test statistic K are intimately related. Consider testing H 0 : = 0 versus H a : = a , and let * denote the test statistic...

-

Consider an 18-month zero-coupon bond with a face value of $100 that can be converted into five shares of the company's stock at any time during its life. Suppose that the current share price is $20,...

-

A new European-style floating lookback call option on a stock index has a maturity of nine months. The current level of the index is 400, the risk-free rate is 6% per annum, the dividend yield on the...

-

What is Merton's mixed jump diffusion model price for a European call option when r = 5%, q = 0, = 0.3, k = 50%, = 25%, S0 = 30, K = 30, s = 50%, and T = 1. Use DerivaGem to check your price.

-

On December 31, Ecology Center, a nongovernmental not-for-profit organization, received an unconditional pledge of $125,000 to be received in three years. The Ecology Center is confident that it will...

-

Productivity is an important goal for Clearwater Electronics. Like most productive organizations, Clearwater recognizes the contributions human resource management (HRM) can make to improve...

-

Forensic accountants usually come in after an alleged financial crime has been discovered. They use a wide variety of skills like investigative skills within the financial data to find the...

Study smarter with the SolutionInn App