Consider the following two new chemical plants, each with an initial fixed capital investment (year 0) of

Question:

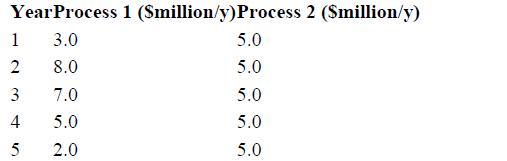

Consider the following two new chemical plants, each with an initial fixed capital investment (year 0) of $15 × 106. Their cash flows are as follows:

Calculate the NPV of both plants for interest rates of 6% and 18%. Which plant do you recommend? Explain your results.

Calculate the DCFROR for each plant. Which plant do you recommend?

Calculate the nondiscounted payback period (PBP) for each plant. Which plant do you recommend?

Explain any differences in your answers to Parts (a), (b), and (c).

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Analysis Synthesis And Design Of Chemical Processes

ISBN: 9780134177403

5th Edition

Authors: Richard Turton, Joseph Shaeiwitz, Debangsu Bhattacharyya, Wallace Whiting

Question Posted: