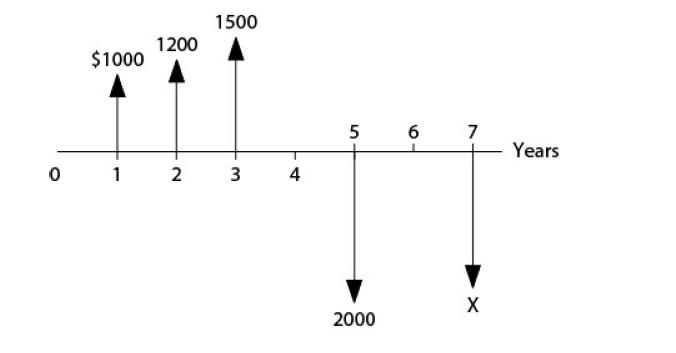

The CFD obtained from Example 9.10 (for the borrower) is repeated in Figure E9.13. The interest rate

Question:

The CFD obtained from Example 9.10 (for the borrower) is repeated in Figure E9.13. The interest rate paid on the loan is 8% p.a.

In year 7, the remaining money owed on the loan is paid off.

1. Determine the amount, X, of the final payment.

2. Compare the value of X with the value that would be owed if there were no interest paid on the loan.

Example 9.10

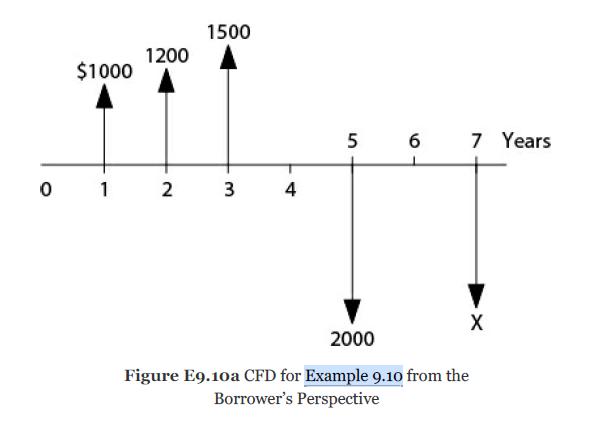

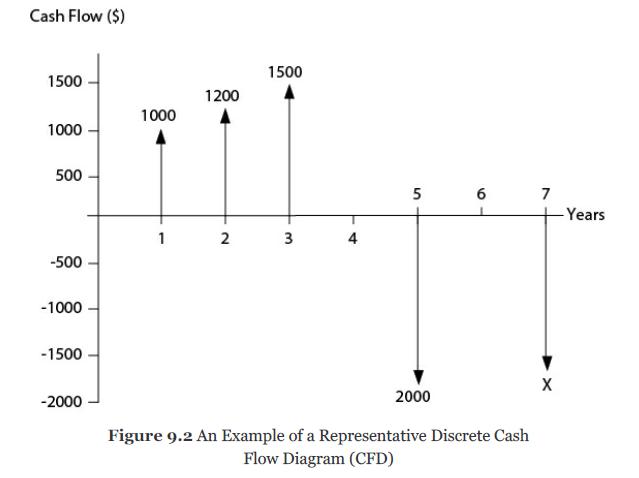

$1000, $1200, and $1500 is borrowed from a bank (at 8% p.a. effective interest rate) at the end of years 1, 2, and 3, respectively. At the end of year 5, a payment of $2000 is made, and at the end of year 7, the loan in paid off in full. The CFD for this exchange from the borrower’s point of view (producer) is given in Figure E9.10(a).

Figure E9.10(a) is the shorthand version of the one presented in Figure 9.2 used to introduce the CFD.

Draw a discrete cash flow diagram for the investor.

The bank represents the investor. From the investor’s point of view, the initial three transactions are negative and the last two are positive.

Step by Step Answer:

Analysis Synthesis And Design Of Chemical Processes

ISBN: 9780134177403

5th Edition

Authors: Richard Turton, Joseph Shaeiwitz, Debangsu Bhattacharyya, Wallace Whiting